Trump’s revived lunar policy has ignited a new space race – this time with China – and the countdown is already on.

Share This

Saturday, February 14, 2026

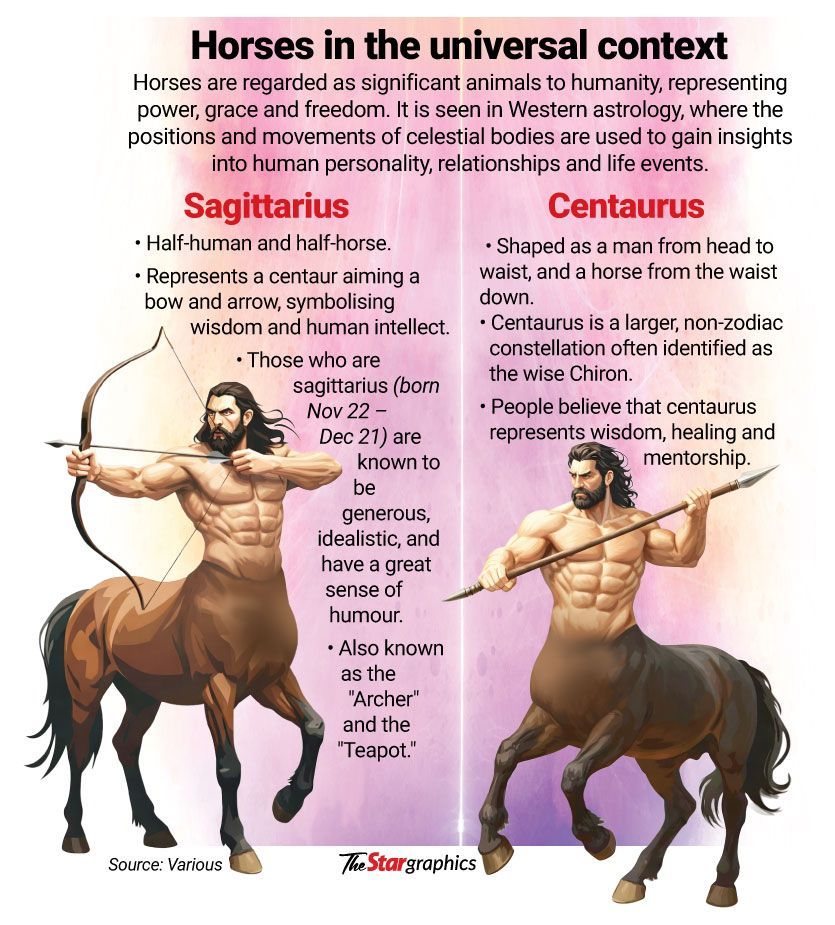

New Year of Fire Horse brings ‘rapid change’ in 2026

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Friday, February 13, 2026

New Year of Fire Horse brings ‘rapid change’ in 2026

The Fire Horse Effect—Why Powerful Women Are Still Labeled ‘Too Much’

PETALING JAYA: The Year of the Fire Horse is expected to bring fast-moving opportunities, stiff competition and rapid change, with success favouring those who act boldly but think clearly, according to feng shui and metaphysics practitioners.

They said 2026 carries strong forward momentum, but warn that impulsive decisions and reactive thinking could lead to missteps in a year defined by speed, intensity and transformation.

In Chinese metaphysics, they added, each year is governed by a combination of a zodiac animal and one of the five elements – Wood, Fire, Earth, Metal and Water – which rotate in cyclical patterns.

2026 is classified as a Fire Horse year because it combines the Horse zodiac with the Fire element – a pairing associated with movement, ambition, visibility and acceleration, they said.

“The horse symbolises momentum and forward drive, while fire represents intensity, leadership and transformation.

“Together, they form a high-energy cycle often linked to rapid shifts, heightened competition and expanding opportunities but also greater risks when decisions are made impulsively,” said feng shui and geomancy consultant Prof Joe Choo Sook Lin.

Choo said the Fire Horse year reflects a period where growth potential builds steadily rather than explosively.

She described 2026 as a phase where opportunities emerge gradually, with momentum strengthening over time rather than arriving instantly.

Metaphysics expert Desmond Chun Yew Leong said personal grounding remains just as important as external action.

He encouraged Malaysians to return to basics, starting with family, intention and mindset.

“When nothing seems to move smoothly, start at home. Spend time with your parents or elderly family members, not just during Chinese New Year but regularly. Maintaining that bond often has a grounding effect that goes beyond symbolism,” he said.

“It’s not about rituals. When you reconnect with your parents, your heart settles. When your heart is steady, your decisions become clearer,” he added, describing parents as a form of gui ren (noble support).

Chun also encouraged charity and good deeds, stressing intention over expectation.

“Charity is about the cultivation of the heart. If you expect returns, the purpose is lost. When you feel adequate and at peace, you act with steadiness, which helps you navigate challenges,” he said.

He added that character plays a crucial role in both life and career.

“Being kind and responsible builds trust, reputation and relationships, which in metaphysical terms attracts supportive energy from those around you,” he said.

Chun also suggests spending time in positive environments, such as morning visits to temples, as a way to refresh energy and maintain balance.

“Before trying to change fate, take care of the heart. Many answers start at home,” he said.

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Thursday, January 22, 2026

View the ‘shocking’ university ranking with composure

Photo: VCG

The newly released "Leiden Rankings" from the Netherlands has recently drawn widespread attention. Eight of the world's top ten universities on the list are from China, with Zhejiang University ranking first, while Harvard University of the US - long a fixture at the top - fell to third place. The results sparked intense discussion. The New York Times published an in-depth analysis under the headline Chinese Universities Surge in Global Rankings as US Schools Slip, while France's Le Monde reported on January 20 that the ranking had triggered widespread shock, noting that the rise of Chinese universities has made the West less certain of itself. How should one view this "shocking" ranking? Our answer is simple: with composure.

First, the ranking does reflect, to a considerable extent, China's advances in education and science and technology. The Centre for Science and Technology Studies at Leiden University in the Netherlands, which publishes the ranking, is highly respected in the global field of scientometrics. The ranking focuses primarily on research output in high-impact international academic journals. Chinese scholars have ranked first globally for years in both the volume of SCI-indexed papers and citation counts. Judged by these criteria, it is hardly accidental that Chinese universities occupy eight of the top ten positions. In 2025, China's research and development (R&D) spending intensity reached 2.8 percent, surpassing the average of economies in the Organization for Economic Co-operation and Development (OECD) for the first time. The rise of many Chinese universities in the rankings is therefore a natural outcome of China's long-standing commitment to the strategy of invigorating China through science and education, coupled with sustained increases in research investment.

Most of the Chinese universities ranked in the top ten are research-oriented institutions with strengths in science and engineering, such as Tsinghua University, Zhejiang University, and Shanghai Jiao Tong University. What the ranking effectively "captures" is the growing competitiveness of China in fields such as electronic communication, materials science, physics, and chemistry. From Huawei's 5G technologies to the Tianhe supercomputers, and to the quantum satellite "Micius," Chinese university research teams have played a direct, critical, and in-depth role behind these achievements. The continuous flow of innovation generated by Chinese universities has been a powerful driver of China's transition from a major manufacturing country to a major science and technology power.

However, it is important to remain clear-eyed about the limitations of this ranking, which has a distinct focus - or preference. It places greater emphasis on universities' performance in academic research publications, reflecting only part of the picture rather than the whole. Judged by more comprehensive indicators, the more widely recognized global university rankings remain the QS World University Rankings, the Times Higher Education World University Rankings, and ShanghaiRanking's Academic Ranking of World Universities. In these rankings, universities from the US and the UK continue to dominate the top tiers. In terms of research originality, global talent attraction, and employer reputation, established Western universities still enjoy advantages. These gaps also serve as a reminder that the overall strength of Chinese universities - particularly their capacity to translate integrated technologies into real-world applications and their models for cultivating innovative talent - still has room for further improvement.

Even so, in early 2000, the same Leiden Ranking still had seven US universities among the top 10, while Zhejiang University only made it into the top 25. Today, although Harvard produces even more research than it did back then, it has slipped to the third place. Given the progress made by Chinese universities over the past two decades, it is hardly difficult to understand why Western media might feel "shocked." This ranking has overturned many long-held perceptions. In fact, Chinese universities did not seize the spotlight "overnight." In recent years, from advances in basic research and breakthroughs in frontier technologies to leaps in strategic industries, China's scientific and technological rise has long been visible to the world. As universities serve as a "reservoir" for scientific and technological development, it is only natural that higher education institutions have made corresponding gains.

As for some Western media outlets linking the Leiden Ranking to narratives of "shifting power" or even a "new world order," this is an overreaction. Behind such "shock" lies Western anxiety over the erosion of technological hegemony. In reality, the progress of Chinese universities does not imply the failure of the West; rather, it represents a "collective increment" in humanity's overall creation of knowledge. From Harvard's liberal education to Stanford's entrepreneurial incubation, drawing on advanced educational philosophies from developed countries has itself been part of the progress of Chinese universities. At a time when global knowledge cooperation is becoming ever more closely intertwined, only by breaking free from zero-sum thinking can humanity's scientific enterprise advance together.

In a sense, the Leiden Ranking is like a mirror, reflecting both our achievements and our shortcomings. Every year, many Chinese students cross oceans to pursue their studies, with venerable Western institutions such as Harvard and Oxford remaining their "dream schools." We also hope that in the future, more international students will come to regard Chinese universities as their own "dream schools" and choose to study in China. That would be a far more persuasive kind of "ranking."

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Tuesday, December 30, 2025

Tech war endgame

THROUGHOUT this year, the most incessant and pernicious concern most countries share has been Washington’s “reciprocal” tariffs.

The fact that Donald Trump hit the whole world with tariffs since returning to office in January assured him of global attention, but of the negative sort.

Grabbing world headlines while confounding critics was classic Trump. The surprise came in how spiralling US tariffs against China were abruptly deflected onto the rest of the world instead.

That resulted from what must have been a surprise to the Trump administration itself: tariffs on China were suddenly halted in their tracks when Beijing hit back with counter-tariffs of its own.

Moral of the story: respond innovatively, don’t just succumb. Pull some surprises of your own.

Trump 2.0’s tariffs had another unintended consequence – lumping allies, partners and everyone else together with its perceived adversaries. This assertion of hard power came at the expense of its soft power and international credibility.

The US had underestimated China’s capacity again. Multiple examples abound of how two can play Trump’s game of trade shock and awe.

This is by now a standard principle of Us-china rivalry: squeeze Beijing hard, and get an unintended and opposite effect. The lesson was never learned – tariffs, sanctions and bans have only spurred China to achieve more and grow stronger.

From its own International Space Station Tiangong and the world’s first moon landing on the far side to breakthroughs in quantum computing and nuclear fusion technology, China’s gains have multiplied when challenged. And the US appears all set to continue this unwitting “assistance”.

The Deepseek moment when China achieves equivalent or better success with higher value, in less time, and at lower cost has become almost routine. Deepseek itself was followed by Moore Threads, whose billion-dollar status, early IPO and massive oversubscription on opening day thrashed all its Western peers by a stunning factor of several thousand.

Among China’s more recent technological feats is Shenzhen’s Extreme Ultra-violet (EUV) lithography prototype. This triumph against the odds came despite, or rather because of, the US ban on sales of EUV machines to China.

It followed the familiar and flawed assumption that China cannot build competitive technology of its own. This myth persists despite repeated warnings from tech industry leaders in the West.

Former ASML CEO Peter Wennink had predicted that Us-led Western pressure against China’s technological development would only backfire by massaging its STEM prowess. Nvidia CEO Jensen Huang observed that China was only ‘nanoseconds’ behind in making the world’s most advanced chips.

Nvidia designs high-end chips made by Taiwan’s TSMC with ASML’S EUV equipment from the Netherlands. The US has tried hard to keep China out of this vital supply chain, but with steadily diminishing success.

Such futility stems from failure to appreciate the interconnectedness of global industry and all its implications, and not least China’s already considerable capacity galvanised by its irrepressible will to succeed. The condescending attitude that “China can only copy, not innovate” adds to its determination to beat all the odds.

Prior to China’s launch of the Asian Infrastructure Investment Bank (AIIB) a decade ago, US cynics said China had nobody competent to run it. But it appointed founding President Jin Liqun, a respected professor and senior veteran of the World Bank, the Asian Development Bank and China’s Finance Ministry.

It happened again with Deepseek and Moore Threads, under their founding CEOS Liang Wenfeng and James Zhang. Since the Western commentariat had not heard of them, the capacity they represented was deemed non-existent.

Yet a 23-year-old Liang was already leading his Chinese team in collecting data on financial markets while the US was struggling with the Great Recession of 2008. Zhang is a 14-year veteran of Nvidia and its former Vicepresident.

Another shock to the West came with the Shenzhen EUV prototype passing all its scheduled tests. Among its lead scientists is Lin Nan, former head of ASML’S photolithography department key to making the world’s most powerful chips.

China is also experimenting with graphene and photonic chips, potentially leapfrogging today’s silicon-based versions by multiple generations. Meanwhile a gushing ‘brain drain’ of tech talent from the West to China approximates to a flood.

After Chinese nationals in toptier Western corporations and institutions returned to China, ethnic Chinese from the diaspora followed, then skilled Westerners migrated as well. The US Congress sounded the alarm and called for reversing the trend, but to no avail.

Migrating scientists are not just attracted by generous new contracts. US agencies are imposing damaging cuts in R&D funding and tough visa restrictions on foreign talent.

Asians are particularly affected after being made to feel unwelcome in the US socially, politically and professionally. The US tally of own goals continues to see a scoring spree.

The tariffs are Washington’s threat to tax itself unreasonably. Savvy countries calling its bluff remain free to develop their own inventiveness, with fresh resilience and leverage as accompaniment.

Renaissance Strategic Research Institute and Honorary Fellow of the Perak Academy. The views expressed here are solely the writer’s own.

Related

2025 in Review with Professor Martin Jacques

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Monday, December 15, 2025

China’s core AI industry poised to surpass 1 tln yuan this year, fueled by applications, tech advances and policies: expert

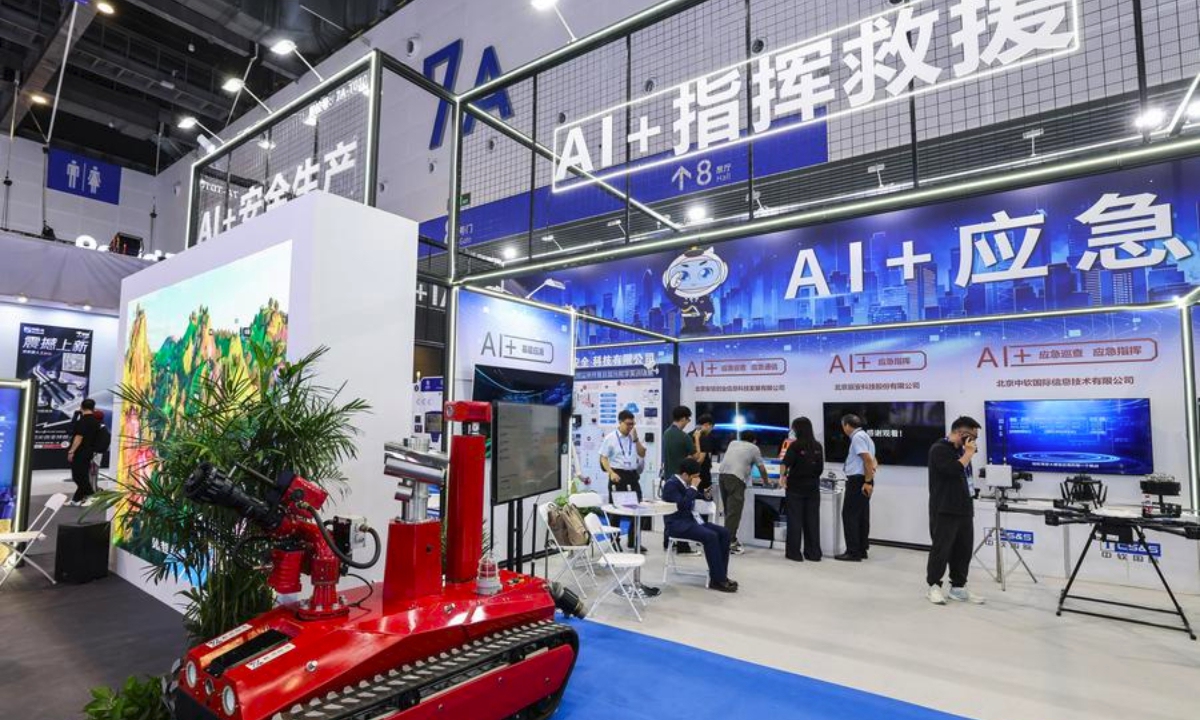

People visit the artificial intelligence exhibition zone at the 4th Global Digital Trade Expo in Hangzhou, east China's Zhejiang Province, Sept. 25, 2025. (Xinhua/Xu Yu)

China's core artificial intelligence (AI) industry scale is expected to exceed the 1-trillion-yuan ($140 billion) benchmark in 2025, according to industry data, a trend that experts said highlights the vast potential of the country's AI development, driven by broader application scenarios, technological progress and policy support.

According to the China Academy of Information and Communications Technology (CAICT), China's core AI industry exceeded 900 billion yuan in 2024, up 24 percent year-on-year, China Media Group reported on Sunday. In 2025, the figure is expected to surpass 1.2 trillion yuan, with growth accelerating further, the report said.

Since the beginning of this year, the application of large-language AI models in the manufacturing segment has expanded significantly, with the share of application cases rising from 19.9 percent last year to 25.9 percent, helping drive rapid growth in the overall AI industry, according to the report.

Multiple factors have underpinned the fast development of China's AI industry, among which are broader application scenarios that outpace those of many countries in terms of market scale and demand, Ma Jihua, a veteran technology industry analyst, told the Global Times on Sunday, citing cases spanning the internet, financial services and manufacturing sectors.

In addition to the traditional sectors, new scenarios have emerged and are driving an upgrade of the consumption structure. According to business big data monitoring, in the first 10 months of this year, China's online sales of smart wearable devices such as AI glasses and smart watches grew by 23.1 percent, with smart products playing an important role in boosting consumption and stimulating economic growth, according to the CAICT.

Moreover, technology advancements are taking shape. Pre-trained large-language models, represented by DeepSeek and others, continue to achieve breakthroughs, driving AI to evolve from perception to cognition, from analytical and judgment-based capabilities to generative functions, and from specialized to general-purpose applications, Ma said, highlighting the continuous technology advancement of Chinese enterprises in the field.

According to a report released by the Chinese Academy of Cyberspace Studies at the 2025 World Internet Conference Wuzhen Summit in November, China has become the world's largest holder of AI patents, accounting for 60 percent of the global total.

The domestic chip industry, a key driver of AI, is also thriving. According to data from industry analysis firm TrendForce, China's domestic AI chips surpassed a 50 percent share in Chinese data centers in the fourth quarter of 2024, the Paper reported, as a new alternative to some imported chips from the US.

China has outlined a roadmap for advancing the "AI Plus" initiative. According to a set of guidelines unveiled by the State Council in August, China aims to achieve extensive, in-depth integration of AI across six key sectors by 2027. The core industries of the intelligent economy will see rapid growth, while AI's role in public governance will be significantly enhanced, the Xinhua News Agency reported.

By 2030, AI will comprehensively empower China's high-quality development. The intelligent economy will become a key driver of the country's economic development. Access to AI technology will be expanded, enabling more people to benefit from it, the report said.

"AI is reshaping every industry, from e-commerce and gaming to communications and manufacturing... Its applications have expanded dramatically in recent years, especially as AI technologies enter the automotive, robotics, and agricultural sectors, covering broader domains and directly promoting advances in cutting-edge industrial technologies, making AI a strategic focus for national competitiveness," Liu Dingding, a Beijing-based internet analyst, told the Global Times on Sunday.

In the course of its development, China's greatest advantage in AI lies in its vast application scenarios and large market, and combined with supportive policies, this will allow the field's potential to continue to be unleashed, Liu said.

At the same time, China maintains an open and cooperative approach in AI development, Liu said, citing the country's proposal to establish a World Artificial Intelligence Cooperation Organization, a living example of sharing growth opportunities with global partners.

China's core AI industry poised to surpass 1 tln yuan this year, fueled by applications, tech advances and policies: expert

China's core AI industry poised to surpass 1 tln yuan this year, fueled by applications, tech advances and policies: expert

China's core artificial intelligence (AI) industry scale is expected to exceed the 1-trillion-yuan ($140 billion) benchmark in 2025, according to industry data, a trend that experts said highlights the vast potential of the country's AI development, driven by broader application scenarios, technological progress and policy support.

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Wednesday, October 22, 2025

Moon race on a deadline

A Long March-2F rocket, carrying the Shenzhou-19 spacecraft and a crew of three astronauts, lifts off from the Jiuquan Satellite Launch Centre in the Gobi Desert, northwest China. — TNS

A Long March-2F rocket, carrying the Shenzhou-19 spacecraft and a crew of three astronauts, lifts off from the Jiuquan Satellite Launch Centre in the Gobi Desert, northwest China. — TNS“If you really want to beat the Chinese, give Nasa the funding and stability it needs. You’re not going to win if every week there’s a new direction, a new budget, a new administrator.” -by G. Scott,Hubbard

EARLY in his first term, US President Donald Trump held a modest ceremony directing Nasa to return humans to the moon for the first time in half a century – a lofty goal with no clear road map.Veterans of the space community were torn between excitement and concern.Was Trump offering a windfall to aerospace contractors or charting a genuine strategic vision to reclaim American leadership in space?The idea wasn’t new.President George W. Bush had proposed a similar plan in 2004, only for Barack Obama to abandon it six years later.

For decades, Nasa wrestled with the question of whether to return to the moon or leap straight to Mars – each path promising scientific glory but demanding vast, steady funding from a fickle Congress.

Eight years on, that debate is over.

Both nations are targeting manned lunar landings by 2029, a symbolic year marking the end of Trump’s presidency and the 80th anniversary of the People’s Republic of China.

But unlike the Cold War’s first space race, this contest is not about planting flags. It’s about who gets to stay.

Washington’s Artemis programme aims to establish a permanent base to test life beyond Earth.

Beijing has similar ambitions – and both are zeroing in on the same spot: the moon’s South Pole, where peaks of eternal sunlight border deep, shadowed craters believed to contain frozen water.

Whichever nation establishes a foothold first could claim the region – and the resources – for itself.

“The bottom line is, yes, it’s doable,” said G. Scott Hubbard, a veteran of human space exploration and Nasa’s first “Mars czar”.

“But it’ll take intense effort and proper funding. It’s not inconceivable – but it’s a stretch.”

Nasa officials fear that funding cuts and private-sector delays could hand China an early lead.

The Trump administration has proposed slashing the agency’s research budget by nearly half, fuelling uncertainty within Nasa at a critical moment.

“There’s too much uncertainty,” said one official. “Inside headquarters, everyone’s walking on eggshells.”

In the 1960s, the US government poured 4.4% of GDP into Nasa to win the space race.

Today, the share is less than 0.5%.

White House officials insist Trump is committed to making “American leadership in space great again”.

Acting Nasa administrator and Transportation Secretary Sean Duffy said: “Being first and beating China matters because it sets the rules of the road. Those who lead in space lead on Earth.”

Beijing, meanwhile, is steadily ticking off milestones. It recently launched its Lanyue lander – built to carry two taikonauts (China’s term for astronauts) – validating its take-off and landing systems, according to state media.

Two tests of its new Long March 10 super-heavy rocket were declared “complete successes” by the China Manned Space Agency.

“They’re progressing on every key piece they’ll need,” said Dean Cheng, a China expert at the US Institute of Peace. “They’ve built a new rocket, a lunar lander and they’re moving faster than anyone expected.”

China has accelerated its timeline from 2035 to 2029 and plans to start building a joint lunar research base with Russia by 2030, most likely at the South Pole.

“There’s room for two powers – but not without coordination,” warned Thomas Gonzalez Roberts, a space policy scholar at Georgia Tech. “Competition for the same landing sites could turn risky.”

China’s goal, experts say, is to arrive first and establish broad control – securing access routes, communications, dig sites and even a nuclear reactor to power its base.

Nasa’s own plans depend on Elon Musk’s Starship rocket – a giant, reusable launcher built by SpaceX and central to Trump’s Artemis vision.

But repeated test failures have put the schedule in jeopardy.

“Starship has yet to reach orbit,” Hubbard said. “And once it does, it’ll need to prove it can transfer cryogenic fuel in space – something never done before. Doing all that within two years is a real stretch.”

Delays have already pushed Artemis III, the first planned lunar landing, towards the end of Trump’s term.

Artemis II – a manned orbit around the moon – is expected early next year after design flaws in Lockheed Martin’s Orion capsule were fixed.

Trump’s aides fear Beijing could deploy a nuclear reactor on the moon by 2029, allowing it to declare a “keep-out zone” and block American operations nearby.

Duffy has ordered Nasa to prepare a competing US reactor mission by the same year.

Yet, uncertainty persists.

Trump has not nominated a permanent Nasa administrator and the White House declined to identify who is overseeing the lunar effort.

Even Trump’s broader space agenda is shaky.

His administration has proposed cancelling funding for Nasa’s Mars Sample Return mission, a cornerstone of planetary science, despite evidence that the Red Planet once supported life.

Setbacks are part of the space game, but China’s pace has turned them into a liability.

If Beijing lands first, it would not just be a symbolic victory – it could reshape power dynamics on Earth.

“I’ve been on the inside,” Hubbard said. “You waste enormous time fighting budget battles.

“If you really want to beat the Chinese, give Nasa the funding and stability it needs. You’re not going to win if every week there’s a new direction, a new budget, a new administrator.”

Then he paused. “And China may still win,” he said. “That would be another claim that they’re the dominant power in the world.” — Los Angeles Times/TNS

Relates posts:

Do not misread China, Victor Gao on How the US Misunderstands China

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM

Rightways - Sowing the seeds of Success:

Think Global, Act Local; Change & Grow Rich; Sow as You Reap & Soar High!

Richard Tan

MBA(UK), BCA(NZ), AMA(USA),MMIM