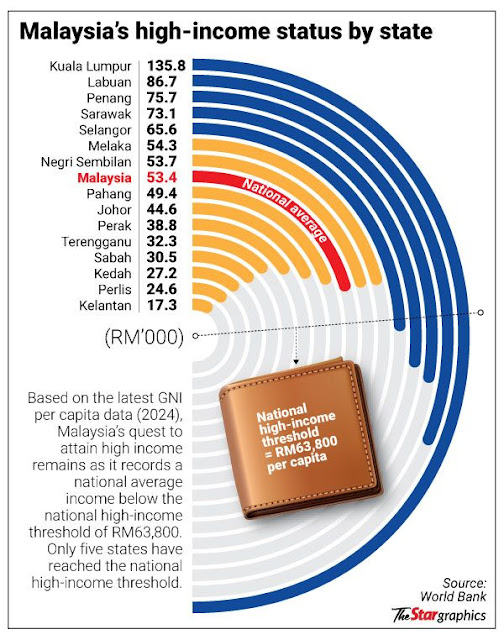

HERE’S the good news – the World Bank has declared Kuala Lumpur, Labuan, Penang, Sarawak and Selangor to be high-income states. The bad news, though, is that Malaysia as a whole is not there yet.

This is the latest high-income data based on Gross National Income (GNI), which is the total amount of factor incomes earned by the residents of a country. The country’s GNI per capita of RM53,400 annually falls short of the high-income threshold of RM63,000.

Kudos to Sarawak as it has solidified its position since joining the high-income state ranks in 2023. It must be doing something right.

Three years ago, there were only three states – Penang, KL and Labuan – on the list but Sarawak joined two years ago and Selangor made the cut last year.

Now, there are a total of five high-income states (including federal territories) but the vast majority of states are below the threshold – and that’s not good as they exert a pull on the country as a whole as it bids to join the club.

The findings, however, do not come as a surprise. Malaysia remains caught in the middle-income trap.

We are too rich to compete with low-cost economies like Vietnam and Cambodia but we are just unable to stand alongside high-income nations like South Korea and Singapore.

South Korea, once poorer than Malaysia in the 1960s, is now a global tech powerhouse. It achieved this through strategic industrial policy, heavy investment in education and R&D, and a relentless focus on productivity.

Singapore, without natural resources, became a financial and innovation hub through clean governance, meritocracy, and human capital development.

Malaysia now finds itself outpaced by these countries that were once on equal or even lesser footing, and if we are not serious about moving up, we could soon be overtaken by Vietnam.

This is not just about achieving a statistical milestone. It’s about ensuring Malaysians enjoy better jobs, stronger public services, global competitiveness, and the ability to keep our brightest minds at home.

The next five years will thus be crucial for Malaysia. We can’t afford to miss the boat.

The upcoming 13th Malaysia Plan (RMK13), covering 2026-2030 and Budget 2026 need to address the issues that are holding us back from becoming a high-income country. If we don’t, we will lose out to more of our neighbours.

RMK13 and Budget 2026 may represent our last – and best – chance to break free and secure high-income status.

For a start, the plans must boldly tackle governance and institutional weaknesses. Policy inconsistency, bureaucratic inefficiency, and rent-seeking behaviour continue to erode investor confidence.

RMK13 must be reform-driven and bold. It cannot be business as usual. Certainly, we don’t need the plan to be tabled with poetic language. It’s the content that matters.

A high-income country needs not only a strong economy, but strong institutions. For one, the judiciary has to be protected and judges must be persons of integrity. Perception is important.

A strong political will is also essential and Malaysia certainly cannot keep changing prime ministers and governments.

We need to fund the future, not the past, and we cannot live like we did in the past, with heavy subsidies which have spoiled Malaysians.

Where RMK13 provides the vision, Budget 2026 must be the engine. Fiscal policy must be repurposed not just to spend, but to invest – in people, productivity, and innovation.

As the world moves rapidly toward a knowledge- and innovation-based economy, Malaysia is at a critical juncture.

We have to increase funding for TVET (technical and vocational education and training), with incentives tied to graduate employability. Among others, we need:

> STEM scholarships and national reskilling initiatives for workers displaced by automation.

> Tax incentives and matching grants for R&D, automation, and green technologies.

> Expanded digital infrastructure, particularly in rural areas, to promote inclusive growth.

> A Malaysian Innovation Fund to support start-ups in Artificial Intelligence, biotech, and climate tech

Malaysia must address its productivity crisis. Growth can no longer rely on cheap labour or natural resources. We must transform our industrial base through digitalisation, automation, and a strong pivot towards advanced manufacturing and services.

This means supporting high-value sectors like semiconductors, electric vehicles, biotechnology, and green energy.

To make these a reality, we must overhaul our education system. Our youth are entering a job market that demands digital skills, creativity, and adaptability.

Are our tertiary institutes producing the right kind of graduates who are trained and marketable? Malaysia needs graduates with strong technical skills in in-demand fields like IT, engineering and healthcare.

Strong soft skills, adaptability and an entrepreneurial mindset certainly help. It will be even better if they have the ability to speak and write in Bahasa Malaysia, English and Chinese.

With due respect, the teaching of the Laos and Cambodian languages in our schools can wait even though they may be just elective courses.

Within Asean, Malaysia has advantages over some member countries. Beside our language skills, we have an established legal system, and we have the British to thank for that.

Malaysia has a strong middle-class base as well as a sound political system. Our democratic system can be noisy at times but it’s often restrained.

Malaysia has enough lawyers and doctors and it doesn’t help that every year we produce students with a string of distinctions who believe they are entitled to places in the top universities in the country.

Are the distinctions secured by our SPM students even on par with the standards imposed by Singapore, Hong Kong and the United Kingdom?

RMK13 must prioritise TVET reform, industry-academia collaboration, and investments in STEM (science, technology, engineering and mathematics) education from an early age.

We are still talking about STEM while China is already introducing AI modules – and at primary school level!

Third, the plan must put innovation and research at the heart of national strategy. Malaysia currently spends less than 1% of GDP on R&D. To become a creator – not just a user – of technology, this must rise to 2–3%, with strong government-industry-academia partnerships.

At the same time, Budget 2026 must address the brain drain by offering meaningful career paths and incentives for Malaysians abroad to return home – including tax relief, housing support, and leadership fast-tracks for top talent.

Expatriates with skills, and who have worked in Malaysia, surely deserve an easier track to be permanent residents.

Malaysia has the resources, the location, and the population to succeed – but seems to lack the political will and strategic coherence to execute bold reforms. We spend a great deal of time on inconsequential and unproductive political discourse, often on murky issues of race and religion.

Tomorrow’s investments in Malaysia are no longer about setting up factories, which outdated aging politicians still seem to think about when questioned about where foreign direct investments would go.

All is not lost, though. Attaining high-income status is not easy for any state or country. This year only one nation – Costa Rica – moved from upper middle income to high-income category.

But it is certainly not going to be easy for Malaysia. No one can predict what next year may bring given the uncertain and volatile economic outlook which doesn’t bode well for trading nations like Malaysia.

The World Bank high-income threshold is not fixed and it adjusts its measurement each year, so a lot depends on how Malaysia would compare with other nations but let’s not forget that even if we grow, other countries could compete harder and that could make the high-income goal even more distant.

Malaysians, especially the politicians, must understand this for the interest of the nation.

Look at the graph – the bottom three worst performing states are Kedah, Perlis and Kelantan, which speaks volumes. We can’t help these states if they prefer politicians who have promised them a ticket to heaven, while little is done for the here and now.

RMK13 and Budget 2026 can change that – if they are driven by vision, evidence, and courage.

For the country, the window to become a high-income nation is closing. We must act – boldly, intelligently, and urgently – before it shuts for good.

On the Beat | By Wong Chun Wai

(IOIProp), OSK Holdings Bhd

(IOIProp), OSK Holdings Bhd , Sunway Group Bhd and Sime Darby Property Bhd

, Sunway Group Bhd and Sime Darby Property Bhd .

. is expected to list its portfolio of assets next year, valued at around RM2bil.

is expected to list its portfolio of assets next year, valued at around RM2bil.