KUALA LUMPUR: Loss of jobs, harm to diplomatic ties with China, damage to the economy plus a RM20bil compensation are awaiting Malaysia if the East Coast Rail Link (ECRL) project is cancelled.

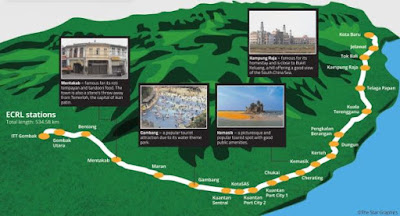

The billion ringgit 688km long track linking Selangor, Pahang, Trengganu and Kelantan is already 20% completed, says MCA president Datuk Seri Dr Wee Ka Siong on the trail of potential damage if the project set for completion in 2024 is axed now.

The Ayer Hitam Member of Parliament who issued an open letter to Prime Minister Tun Dr Mahathir Mohamad and Cabinet Ministers on the matter, said he earnestly hoped the Cabinet can explore the effects of axing the project.

The ECRL project whose construction contract was awarded to China Communications, Construction Co Ltd (CCCC) and financed by China is a hot topic in the past few days, and its fate is expected to be made known officially this week.

Yesterday, Dr Mahathir said Malaysia will be “impoverished” if the government proceeds with the ECRL project.

While not confirming that the project has been scrapped, Dr Mahathir said paying compensation is cheaper than bearing the cost of the project.

Below is Dr Wee’s letter in full:

Below is Dr Wee’s letter in full:An open letter to YAB Prime Minister and Cabinet Ministers

The cancellation of the ECRL project and the bickering between two Cabinet ministers over the issue has become the talk of the town. I foresee this issue to be a hot topic in the Cabinet meeting this Wednesday (Jan 30).

Whether the cancellation of ECRL was discussed in previous Cabinet meetings or not, I earnestly hope the Cabinet can explore the effects of axing this project.

Take a moment to consider factors such as the friendship between the people of both countries, jobs and economy, diplomatic ties and the reputation of Malaysia.

On the bilateral relations between Malaysia and China, I can safely say that putting a stop to the ECRL project will harm the diplomatic ties between Malaysia and China.

If we put ourselves in China’s shoes, we will surely respond negatively as well if our overseas investment is treated as such.

A nightmare looms should China take any retaliatory action, such as reduce or even halt the import of commodities (palm oil in particular) from us.

If that happens, Felda, Sime Darby and other big corporations will be the first to feel the heat.

The livelihood of some 650,000 smallholders and their families will be directly affected.

From the economic perspective, the ECRL project is likely to boost the GDP growth of three east coast states by 1.5%.

It will also spur the development of the east coast, enhance connectivity between the east and west coast, and close the economic divide between the two coasts.

Through bridging the rural-urban divide, the overall development of Malaysia will be more balanced and comprehensive.

The rail link is 20% completed, with several tens of billions paid to the contractor.

On top of that, Malaysia will be penalised for cancelling the RM30bil loan from the EXIM Bank of China.

We will have to repay the loan and compensation within a short period of time.

From my experience in administering engineering projects, any breach of contract will result in a hefty penalty. The compensation for cancelling ECRL could reach RM20bil.

Financial losses aside, scrapping the ECRL will also bring a negative impact to Malaysia’s reputation in the international arena and erode Malaysia’s trustworthiness.

Judging from my past experience dealing with China and its officials, as well as the friendly gestures displayed by China so far, I can conclude that China is willing to achieve a win-win solution instead of situation where both sides lose out.

The Malaysian government can consider restructuring the project timeline or reducing the project scale, which are alternatives that work in Malaysia’s favour while maintaining the amicable ties between Malaysia and China.

The government should also keep the small and medium enterprises in mind.

Business owners in 150 related industries, including tens of thousands of contractors who have taken a loan to purchase equipment, will suffer greatly should ECRL be cancelled.

China is Malaysia’s largest trading partner since 2009, with bilateral trade figures reaching US$100bil. Business linkages and people-to-people exchanges have also flourished over the years.

Products such as palm oil, bird’s nest, Musang King, white coffee, etc, are exported to China, while people from both countries visit each other for vacations and academic exchanges, benefitting Malaysians of all races.

All these have contributed to the income of various communities and brought in foreign exchange earnings for the country.

It takes years to build a bilateral relationship, and only seconds to destroy it.

The Malaysian government should appreciate our friendship with China and try its best to achieve mutual benefits and common prosperity with China.

Prioritise the economy and the livelihood of the people, and put an end to the political game to discredit your opponents.

For the sake of the people in the east coast as well as the whole of Malaysia, the government should not cancel the ECRL project.- The Star

Related posts:

Rail link a huge economic boost, big news for small towns in Malaysia

The rail economics of East Coast Rail Link (ECRL)

ECRL and pipeline projects cancelled !

Malaysia scraps MRT3 project, reviews HSR, ECRL mega projects to reduce borrowings

Don’t brush aside the goodwill, Mahathir !

The world’s oldest PM, Dr. Mahathir must now walk the talk