Global standard: A man walks past a poster showing a US dollar outside an exchange office in Cairo. The dollar has maintained its position as a global standard because it is convenient, cheap to use and a store of value that has so far been subject to minimal political interference. — AP

OVER the Chinese New Year holidays, we were all treated to the Trump Reality Show, changing the world we thought we understood with various tweets or executive orders.

This behaviour reminded me of the Chinese philosopher Zhuangzi waking up and was not sure he was a man dreaming that he was a butterfly, or a butterfly dreaming that it was a man. Mr Trump is either a butterfly disguised as President or a truly smart politician disguised as a butterfly. The tragedy is that the rest of us have to live with the consequences.

This week, after humiliating Mexico and reversing his position on Nato, Trump and his advisers have switched to stoking a currency fire, accusing China and Japan of manipulating their currency and even suggesting that Berlin is exploiting a “gross undervalued” euro.

Whatever you think of Trump, he was smart enough to appoint someone like Steve Bannon as his chief strategist. You always can judge a leader by the people he or she surrounds himself with. Steve Bannon is pure American success story – Harvard trained, ex-Goldman Sachs, ex-navy, and founding entrepreneur of Breitbart news, a platform that claims to represent the alt-right and third most influential news channel after Bloomberg and Reuters.

In a remarkable 2014 speech (https://www.buzzfeed.com/lesterfeder/this-is-how-steve-bannon-sees-the-entire-world), Bannon claimed that (this) ... “is a crisis both of our church, a crisis of our faith, a crisis of the West, a crisis of capitalism.”

Taken on its own, there is nothing wrong with someone having a view of the world in crisis. But Bannon is now in a pivotal position to do something about it.

The dollar has maintained its position as a global standard because it is convenient, cheap to use and a store of value that has so far been subject to minimal political interference.

The rest of the world is now stuck with a “damned if we do, and damned if we don’t” dilemma. If we continue to rely on the dollar, how do we avoid being accused as manipulators, when in reality, so far the market forces are stronger than any central bank on its own? If we don’t rely on the dollar, we will anyway be accused as manipulators, particularly if the currency depreciates against the dollar.

In other words, what is at stake is not a crisis of the West or its faith (which the Rest cannot change), but a crisis of faith within the Rest on the leadership in the West. The dollar remains the anchor of global stability, but when the solo anchor itself is adrift, we need to find alternative anchors. Single anchors are efficient but dangerous if they wobble. We need two or three anchors to triangulate global stability.

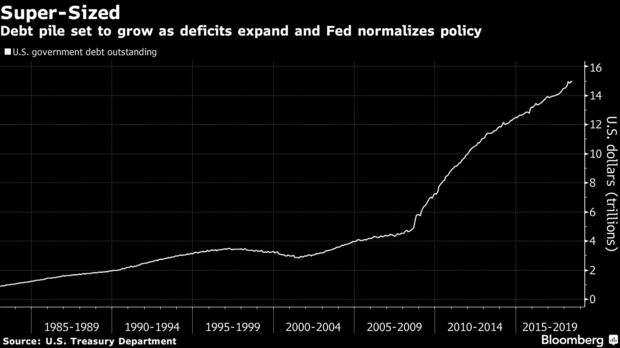

Here is another inconvenient truth – it’s Trump’s dollar, but the Rest’s savings. Based on the US Bureau of Economic Analysis, the US has net global liabilities of US$7.8 trillion or 41.7% of GDP at the end of the third quarter 2016. This has deteriorated from US$2.5 trillion or 16.8% of GDP at the end of 2010. The cumulative current account deficit (from trade) between end 2010-2016 Q3 was only US$2 trillion, which meant that the rest (US$3.3 trillion) was due to valuation changes (change in US dollar exchange rate) or financial account flows.

In other words, it is capital flows rather than trade that is the major driver of the exchange rate, with interest rate differentials influencing also the exchange rate.

If that is the case, going forward, the US net debt position will depend largely on the future global savers, mostly Europe and Asia. And if the savers are subject to constant lecturing by the Trump Administration, an alt-dollar solution will have to be found.

During the Asian financial crisis, Europe sided with the US to reject an Asian Monetary Fund in a move against regionalisation. But if today, the America First strategy is designed at isolating the Rest, then the Rest must unite to protect global trade and investments. If the non-dollar zone can maintain currency stability against the dollar, then there will be less accusations of currency manipulation, forcing the debate into how the US can restore its own fiscal and trade balance to maintain its own savings equilibrium.

In short, the Rest needs to remind the US that she is important, but cannot blame the Rest for all her own problems.

The reserve currency central banks have a major role to ensure currency stability, which can be only preserved by ensuring liquidity and discipline. So far, the Fed has shown responsible leadership, with strong support from the European Central Bank, Bank of England, Bank of Japan and the People’s Bank. But if the dollar is being politicised, then alternatives can and should be found.

All options are now on the table. If the US is no longer dependent on oil and energy, then oil and energy suppliers can price oil trade in currencies other than the dollar. We have seen this before in the competition between different technology standards. The leading standard becomes dominant because it is willing to provide public goods (lots of freebies). But when the dominant standard becomes predatory or extractive in using its monopoly position, then it is time to use alternative standards.

No one should take their position or customers from granted. The Rest will not stand still whilst Trump and his cohorts decide to change allies and foes by the tweet. None of us are against the dollar but for global stability, common sense and mutual respect. The euro, sterling, yen, yuan and SDR’s time has come.

Andrew Sheng writes on global issues from an Asian perspective.

By Andrew Sheng

Year of living dangerously

Rash move: The effectiveness of Trump’s executive order banning citizens of seven countries from entering the US is highly questionable. — AFP

What Trump is doing – and he may not even realise it with his defiant-style leadership – is making the US a much more dangerous place to live in now, not a safer place as he had hoped.

WHEN the world’s most powerful man conducts diplomacy over Twitter, keeping his words to 140 characters, we’d better prepare ourselves for trouble.

And indeed, since Donald Trump took over as President of the United States, there has been a series of totally unpredictable and unconventional decisions made, some mind boggling, even bordering on insanity.

And it has just been a little over two weeks since he moved into the White House.

There is no question that many Americans are troubled by a possible mass influx of refugees from the Middle East and Africa.

This does not involve just the US but also affects several parts of Europe, including Britain, France and Germany, which explains why politicians who play the right-wing card – with the anti-immigrant agenda – are winning.

Trump clearly understands the pulse of the average American, especially those in the rural mid-west, the US heartland.

These are folks who watch conservative Fox TV and whose interaction with people of other races, religions and cultures is limited.

They are not like the liberal city folks of New York or Los Angeles, who turn up at airports and train stations, waving placards and hugging Syrian refugees, as shown on international TV news.

It is probably a different story in Montana, Nebraska, Arkansas or South Carolina but we do not hear the voices of these rural folks on CNN.

Trump won simply because he understood the fears of the average American well. He has continued to play the Islamophobia card because he knows his fearmongering works.

It doesn’t help that most of these refugees want to go to the US or Britain and not the Muslim-majority nations of the Middle East. The question remains if these Arab countries are even offering places to the refugees or do the refugees themselves prefer Western secular and democratic values.

Nationalist politicians have already whipped up anger, pointing out that if these Middle East refugees hate Western culture so much and refuse to assimilate, then why should they be let in.

But Trump’s executive order banning the citizens of seven countries from entering the US, supposedly to protect the nation from “radical Islamic terrorists”, is highly questionable, especially its effectiveness.

The president has signed the order temporarily suspending the entry of people from Iraq, Syria, Sudan, Iran, Somalia, Libya and Yemen into the US for at least 90 days.

This is odd because if we wish to identify terrorism acts, then surely there’s a high number of terrorists from Egypt, Turkey, Saudi Arabia, Pakistan, the United Arab Emirates, Indonesia and Afghanistan. Why were these countries not on the list?

Obviously, Trump did not want to offend US allies, especially Saudi Arabia and Pakistan. Despite the US’ constant lecture on democracy, we all know these two countries are often “spared”, despite their horrifically poor human rights record because they are strategically important to the US. We also should not forget that at one time, the vital oil supply was from Saudi Arabia.

The fact is that in the past four decades, 3,024 people have been killed by foreign terrorists on US soil.

The reality is that the Sept 11 attacks, perpetrated by citizens of Saudi Arabia, the UAE, Egypt and Lebanon, account for 98.6% of those deaths – 15 of the 19 Sept 11 hijackers once called Saudi Arabia home.

In fact, over that period, no American has been killed on US soil by anyone from the nations named in the present president’s executive order.

The San Bernardino massacre, in which 14 people were killed and 22 injured in 2015 was carried out by Syed Rizwan Farook, who is of Pakistani descent, and his wife Tashfeen Malik, who grew up in Saudi Arabia.

The Pulse nightclub attack in Orlando, where 49 died and 53 were injured last year, was carried out by Omar Mateen, a US citizen of Afghan descent.

The Boston Marathon bombing in 2013 was orchestrated by the Tsarnaev brothers, both of whom were Russian, killing three and injuring several hundred people.

But as the world jumped on Trump, news reports have emerged that Kuwait does the same.

Syrians, Iraqis, Iranians, Pakistanis and Afghans have reportedly not been able to obtain tourism or trade visas to Kuwait since 2011.

Passport holders from the countries are not allowed to enter the Gulf state while the blanket ban is in place, and have been told not to apply for visas, it has been reported.

Likewise, the ban on citizens from fellow Muslim-majority nations has failed to prevent Kuwait from being targeted in a number of terrorist attacks over the past two years – including the bombing of a mosque in 2015 which left 27 Kuwaitis dead.

Kuwait is the only country in the world to officially bar entry to Syrians, until the US named Syria among the seven countries whose citizens were banned from entering its borders.

What Trump is doing – and he may not even realise it with his defiant-style of leadership – is making the US a much more dangerous place to live in now, not a safer place as he had hoped.

There will be homegrown terrorists, including Americans – and even radicals entering the US holding other passports – who plan to carry out their crazy acts.

He has also made the work and lives of career diplomats more difficult with his brazen diplomacy. It came as no surprise that 900 State Department diplomats signed a memo to oppose his ban.

According to CNN, the “memo of dissent” warned that not only will the new immigration policy not keep America safe but it will harm efforts to prevent terrorist attacks.

The ban “will not achieve its stated aim of protecting the American people from terrorist attacks by foreign nationals admitted to the United States,” the memo reportedly noted.

Trump has actually provided oxygen to the radicals, who will now thump the noses of moderates in Muslim countries.

There should be no surprises if the recalcitrant Trump expands his list of countries whose citizens would be banned from entering the US.

It won’t be wrong to suggest that 2017 will be a Year of Living Dangerously under Trump. Let’s be prepared for the unexpected from him.

Source: On the beat Wong Chun Wai The Star

Related posts:

China’s President Xi Jinping speaking at the World Economic Forum AP

https://youtu.be/dOrQOyAPUi4 Western dominance on the global s..

Jan 22, 2017 ... Jan 20, 2017, marked the inauguration of the 45th President of the United States,

Donald J Trump. Next week, the Lunar Year of the Monkey ...

Nov 12, 2016 ... I was going to write about disruptive technology but the whole week was taken up

with the disruption that Donald J Trump caused in upsetting ...

|

Jan 2, 2017 ... With his extreme views and bulldozing style, President-elect Donald Trump is set

to create an upheaval, if not revolution, in the United States ...

|