WE will soon be celebrating Chinese New Year and most Chinese families would be busy making preparations for the same.

This is one of the yearly events that I look forward to. Apart from family bonding and catching up on latest family updates, these get-togethers often times allow us to reflect on our past.

When I reminisce about my childhood days, I fondly remembered the life of my late father which has had a big influence on my life.

At the age of 16, my father embarked on a long boat journey to Malaysia with barely anything in his pockets. This was during China’s economic depression. Due to hard work and frugality, he managed to save, starting with owning one taxi to two and the next thing you knew, he owned a bus company, the Kuala Selangor Omnibus Co.

How did he do it? What was his secret?

Unfortunately, my father did not manage to share with me his secrets of success. Nonetheless, I observed that for every dollar he earned, he only spent 30 cents. He was very frugal in his spending even though he had to feed a family of 15.

I recalled accompanying him to Kuala Lumpur on one of his business trips 70 years ago. Back then, the road from Klang to Kuala Lumpur was windy and hilly. To reduce fuel consumption, he would switch off his car engine and let the car slide down the road when the car was at the peak of the slope.

Today, it is not safe to do such a thing due to the increased number of cars on the road. Yet, to my surprise, cars like Mercedes and BMW have incorporated similar feature in their latest models. The point here is there are many creative ways to be frugal and my father would think of his own ways to save.

In the olden days, there were not many entertainment and luxury items up for grab. Being a bus company owner, my father would cycle between home and his workplace every day. My father could easily afford a brand new car, but he chose a second-hand Fiat because to him, a car was a luxury item.

I respected my father for his diligence in practising delayed gratification in his life which allowed him to finance 7 of his 8 sons overseas for tertiary education. He was able to resist the temptation for immediate reward in order to receive a more enduring reward later. I am grateful that I am one of the beneficiaries.

In my memory, I can’t recall my father borrowing money from the banks or friends. Basically, he had no liabilities. Of course, there were also no credit card, personal loan and fancy easy payment or installment plans to go with the purchase of luxury items which would eventually make the items even more expensive, compared to the original/initial price. Now that I think about it, if everyone was like him, many banks would be out of business.

Other than investing in his bus company, he would not invest his money elsewhere except in real estate. When he passed away, he left 4 plots of land in Klang and his company had 34 buses. Being a businessman, he was supportive of his children doing their own business and investing in real estate. Maybe, that was how I got myself involved in real estate and started my first architectural firm and later, a property development company in 1968.

In summary, what I learnt from my father was, money can be allocated for the following usage:

> Expenditure/spending

> Savings

> Investment

Be frugal and practise delayed gratification when it comes to expenditure/spending. Make saving a lifestyle as we may need the funds for rainy days. More importantly, make some investments which can come in many forms and combination. Commodities, properties, shares, trust funds and bonds are the main types of investment available. Bear in mind, investment is also a form of long-term savings. Hence, investing wisely will help you grow your wealth.

Nowadays, most parents invest early in order to fund their children’s higher education. I believe that one of my father’s biggest investment in life was sending his children overseas for further education. Though he has only completed his primary school in China, my father together with my late mother had the foresight to decide that all their eight boys would have to be educated in English.

Except for my eldest brother who stopped at the secondary level to work so he can help my father and the family financially, all the other seven sons were educated in English and eventually led a successful life and career.

By the way, do you know that there are investments which won’t cost you any money? One of them is spending quality time with your family and children. Take this festive season to spend time with them as part of your future investment instead of overindulging on things that may eat into your savings and investment.

For those celebrating, here’s wishing you a prosperous and harmonious Chinese New Year in advance. Gong Xi Fa Cai.

Datuk Alan Tong was the world president of FIABCI International for 2005/2006 and Property Man of the Year 2010 at FIABCI Malaysia Property Award. He is also group chairman of Bukit Kiara Properties. For feedback, email feedback@fiabci-asiapacific.com.

Related posts:

This is one of the yearly events that I look forward to. Apart from family bonding and catching up on latest family updates, these get-togethers often times allow us to reflect on our past.

When I reminisce about my childhood days, I fondly remembered the life of my late father which has had a big influence on my life.

At the age of 16, my father embarked on a long boat journey to Malaysia with barely anything in his pockets. This was during China’s economic depression. Due to hard work and frugality, he managed to save, starting with owning one taxi to two and the next thing you knew, he owned a bus company, the Kuala Selangor Omnibus Co.

How did he do it? What was his secret?

Unfortunately, my father did not manage to share with me his secrets of success. Nonetheless, I observed that for every dollar he earned, he only spent 30 cents. He was very frugal in his spending even though he had to feed a family of 15.

I recalled accompanying him to Kuala Lumpur on one of his business trips 70 years ago. Back then, the road from Klang to Kuala Lumpur was windy and hilly. To reduce fuel consumption, he would switch off his car engine and let the car slide down the road when the car was at the peak of the slope.

Today, it is not safe to do such a thing due to the increased number of cars on the road. Yet, to my surprise, cars like Mercedes and BMW have incorporated similar feature in their latest models. The point here is there are many creative ways to be frugal and my father would think of his own ways to save.

In the olden days, there were not many entertainment and luxury items up for grab. Being a bus company owner, my father would cycle between home and his workplace every day. My father could easily afford a brand new car, but he chose a second-hand Fiat because to him, a car was a luxury item.

I respected my father for his diligence in practising delayed gratification in his life which allowed him to finance 7 of his 8 sons overseas for tertiary education. He was able to resist the temptation for immediate reward in order to receive a more enduring reward later. I am grateful that I am one of the beneficiaries.

In my memory, I can’t recall my father borrowing money from the banks or friends. Basically, he had no liabilities. Of course, there were also no credit card, personal loan and fancy easy payment or installment plans to go with the purchase of luxury items which would eventually make the items even more expensive, compared to the original/initial price. Now that I think about it, if everyone was like him, many banks would be out of business.

Other than investing in his bus company, he would not invest his money elsewhere except in real estate. When he passed away, he left 4 plots of land in Klang and his company had 34 buses. Being a businessman, he was supportive of his children doing their own business and investing in real estate. Maybe, that was how I got myself involved in real estate and started my first architectural firm and later, a property development company in 1968.

In summary, what I learnt from my father was, money can be allocated for the following usage:

> Expenditure/spending

> Savings

> Investment

Be frugal and practise delayed gratification when it comes to expenditure/spending. Make saving a lifestyle as we may need the funds for rainy days. More importantly, make some investments which can come in many forms and combination. Commodities, properties, shares, trust funds and bonds are the main types of investment available. Bear in mind, investment is also a form of long-term savings. Hence, investing wisely will help you grow your wealth.

Nowadays, most parents invest early in order to fund their children’s higher education. I believe that one of my father’s biggest investment in life was sending his children overseas for further education. Though he has only completed his primary school in China, my father together with my late mother had the foresight to decide that all their eight boys would have to be educated in English.

Except for my eldest brother who stopped at the secondary level to work so he can help my father and the family financially, all the other seven sons were educated in English and eventually led a successful life and career.

By the way, do you know that there are investments which won’t cost you any money? One of them is spending quality time with your family and children. Take this festive season to spend time with them as part of your future investment instead of overindulging on things that may eat into your savings and investment.

For those celebrating, here’s wishing you a prosperous and harmonious Chinese New Year in advance. Gong Xi Fa Cai.

Datuk Alan Tong was the world president of FIABCI International for 2005/2006 and Property Man of the Year 2010 at FIABCI Malaysia Property Award. He is also group chairman of Bukit Kiara Properties. For feedback, email feedback@fiabci-asiapacific.com.

Related posts:

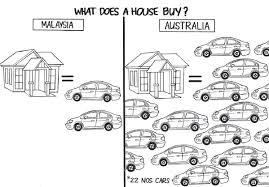

Dec 12, 2015 ... Yes, our homes may not be cheap but our cars are more expensive in .... Property

investments: good Infrastructure a way to huge profits and ...