|

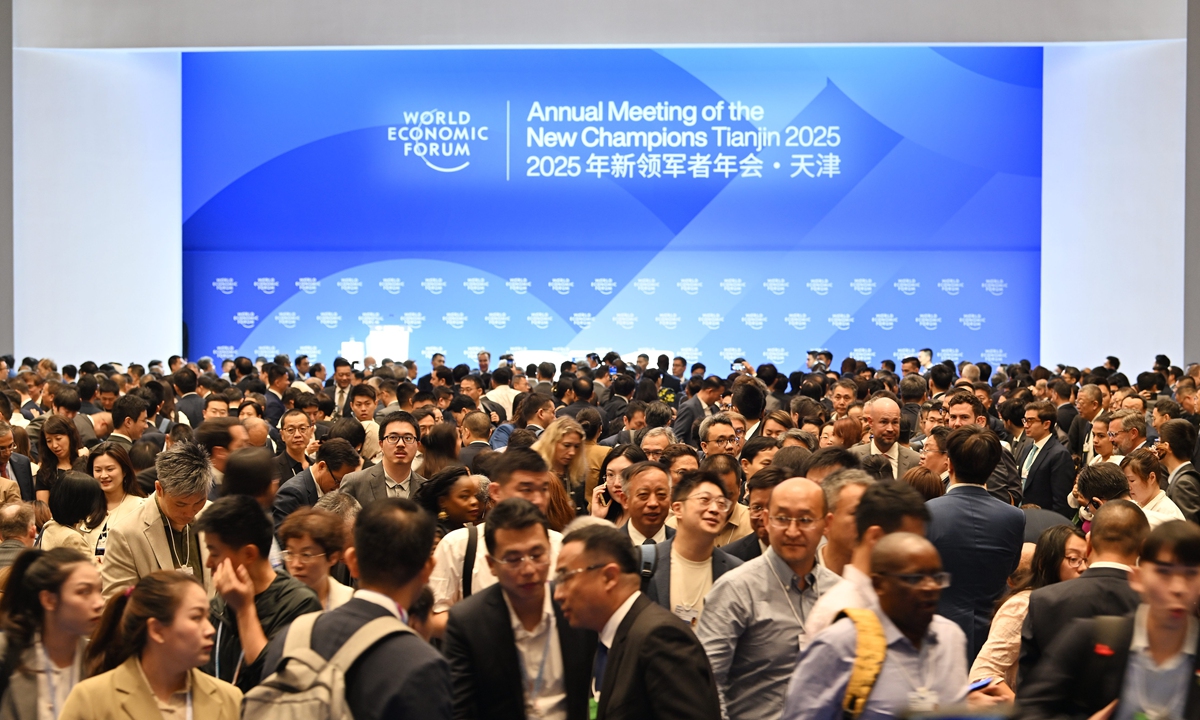

Guests attending the 16th Annual Meeting of the New Champions (AMNC), also known as the Summer Davos, in North China's Tianjin, exit the venue after opening plenary on June 25, 2025. Photo: Xinhua

China is confident in and capable of maintaining rapid economic growth, Chinese Premier Li Qiang said Wednesday, vowing that the country will always keep the doors wide open and warmly welcome businesses from all countries to invest and deepen their roots in China.

Li made the remarks when addressing the opening plenary of the 16th Annual Meeting of the New Champions (AMNC), also known as the Summer Davos, in North China's Tianjin.

Themed "Entrepreneurship for a New Era," the event, held from Tuesday to Thursday, is gathering around 1,800 leading figures from more than 90 countries and regions to explore how entrepreneurship and emerging technologies can unlock more dynamic and resilient economies, Xinhua News Agency reported.

President of Ecuador Daniel Noboa, Prime Minister of Singapore Lawrence Wong, Prime Minister of Kyrgyzstan Adylbek Aleshovich Kasymaliev, Prime Minister of Senegal Ousmane Sonko, and Prime Minister of Vietnam Pham Minh Chinh would also attend AMNC this year, according to an earlier announcement of Chinese Foreign Ministry.

"Over the years, no matter how the international environment has changed, China's economy has consistently maintained a good momentum," Li said, noting that China's GDP grew by 5.4 percent in the first quarter of 2025 despite facing significantly heightened external shocks this year.

China's economic development is not about short-term spurts, but sustained progress toward long-term goals, Li added. He also noted that China is moving toward becoming a high-income country as a whole, driven by strong demand for consumption upgrades in the world's second-largest consumer and import market.

Li said China's sustained breakthroughs and advances in innovation will inject fresh vitality into global development, which will accelerate global economic growth, per Xinhua.

He also called on the international community to take constructive actions in international economic and trade cooperation.

"Constructive actions mean we need to proactively take measures to safeguard free trade and multilateralism and promote the stable development of the world economy," Li said. The premier called for resolving disputes and differences through dialogue.

Li further said China will continue to deepen its integration and connectivity with the world market and strengthen industrial collaboration with various countries.

Premier Li's speech has drawn broad positive response at the Summer Davos, as many international attendees recognize the achievements of China's high-quality development and major contributions to global trade and economic growth, eyeing greater opportunities from China's massive market and pioneering innovations.

Confidence in economy

During the Summer Davos, World Economic Forum President Borge Brende shared an optimistic outlook on China's economic prospects.

"I'm relatively optimistic for the Chinese economy, both in the medium-term and long-term. China has already diversified, in addition, China is pivoting from manufacturing of goods to more services and digital trade. We are also seeing a lot of new technologies being applied. China is doing very well in artificial intelligence (AI), on robotics," he said, reported Xinhua.

"There has been a 5.4 percent year-on-year growth in China in the first quarter this year, and the premier said key economic indicators continued to improve in the second quarter. Even though there are a lot of challenges, China is able to overcome them. That's very positive," Bassam Al-Ibrahim, a representative from General Retirement and Social Insurance Authority of Qatar, told the Global Times on the sidelines of the forum on Wednesday.

Now, China is probably at the forefront of innovation from all the technological aspects, and innovation is going to be one of the driving forces for China, especially AI, Al-Ibrahim said.

Joel Ruet, president of the Bridge Tank in France, said Premier Li's speech continued the theme of his speech delivered at last year's Summer Davos - promoting the country's high-quality development and firm commitment to opening-up.

It's reassuring to see continuity in countries including China and within the ecosystem of entrepreneurs, because we live in a world where we perceive many abrupt changes taking place, Ruet told the Global Times on Wednesday.

Driven by the notable strides in advancing innovation-driven development, China's economy has advanced steadily, and demonstrated robust resilience and development potential.

A recent report released by the World Bank showed that China's economy maintained growth momentum in early 2025, and in response to global trade uncertainty, the government has implemented accommodative monetary and fiscal policies. Recently, international institutions, such as J.P. Morgan and Goldman Sachs, have revised up China's growth prospects.

Call for cooperation

As the world economy is confronted with a worsening growth predicament due to the escalation of geopolitical conflicts and policy uncertainty, global leaders from government, business, academia and other fields at the Summer Davos also called for win-win cooperation and close collaboration to deal with challenges.

Robert Koopman, Hurst Senior Professorial Lecturer with the School of International Service of American University, especially highlighted Premier Li's emphasis on global trade and cooperation and coordination.

"I think there's a deeply ingrained understanding of the importance of access to global markets, of access to global technology, and the positive spillovers that come from that kind of access and cooperation," Koopman told the Global Times on Wednesday.

"This is my first time participating in the Summer Davos, and I'm happy to be here to see the various discussions and collaboration between different governments, public, and business parties from around the world," Hisham Aljadhey, president of Saudi Food & Drug Authority, told the Global Times on Wednesday.

The event provides an important platform for dialogue where governments and businesses are talking about many key economic issues that matter to the world today, seeking understanding and consensus, according to Aljadhey.

Li warns of rising trade barriers

Premier urges nations to reject ‘me first’ economic policies as global strain deepens

Officials including Singaporean Prime Minister Lawrence Wong are among those attending this week’s gathering in the northern port city of Tianjin, known colloquially as the “Summer Davos”.

Li yesterday said the global economy was “undergoing profound changes” – a thinly veiled reference to swingeing tariffs imposed by US President Donald Trump.

“Protectionist measures are significantly increasing and global economic and trade frictions are intensifying,” Li added.

“The global economy is deeply integrated and no country can grow or prosper alone,” he said.

“In times when the global economy faces difficulties, what we need is not the law of the jungle where the weak fall prey to the strong, but cooperation and mutual success for a win-win outcome.”

Beijing’s number two official also painted a bullish picture of the Chinese economy, the world’s second-largest, which has been beset by slowing growth and a lull in consumer spending.

“China’s economy continues to grow steadily, providing strong support for the accelerated recovery of the global economy,” he said.

Beijing, he added, was “stepping up our efforts to implement the strategy of expanding domestic demand”.

Li said this was “promoting China’s growth into a major consumption powerhouse based on the solid foundation of a major manufacturing powerhouse”.

Beijing is eyeing growth this year of around 5% – a target viewed as ambitious by many economists.

Officials have since late last year rolled out a series of steps intended to boost spending, including key interest rate cuts and steps to encourage homebuying.

But results have been varied, just as added pressure on trade from US tariffs threatens to hit the country’s vast manufacturing sector.

Li’s speech at the WEF gathering sought to portray China as a staunch defender of a rules-based international trading system that is now under attack by the Trump administration.

His comments echoed remarks the day before by President Xi Jinping to Singapore’s Wong during a meeting in Beijing in which he called for the countries to resist a “return to hegemony” and protectionism.

Other leaders yesterday shared a sense of unease about being forced to choose between superpowers in a new historical period marked by increasing fragmentation and conflict.

Wong told WEF President and CEO Borge Brende during a public discussion that governments should be cautious about “abandoning the concept of economic integration”.

“Integration cannot guarantee peace, but I think it certainly gives us a better chance for peace than a ‘me first’ approach,” he said.

Vietnamese Prime Minister Pham Minh Chinh struck a similar chord, pointing out that the United States is Vietnam’s largest export market and China its largest source of imports.

When asked about recent trade frictions, Chinh said his country needed to pursue a “balanced” foreign policy that would allow it to be “a friend of all countries”.

“We have a good balance but we also need to be prepared as things have gone topsy-turvy lately,” he added. — AFP