COCONUT and Bagan Datuk are inseparable.

A visit to this district is said to be incomplete without tasting its famously sweet young coconut water – a natural product many claim is unlike anywhere else in the country.

For hundreds of years, coconut has been the community’s primary commodity crop.

Bagan Datuk once earned a place on the world map as one of the most important coconut producing regions from the late 19th to mid-20th century.

Built on the rich alluvial soils at the mouth of Sungai Perak and blessed with a humid tropical climate, the region is naturally suited for growing Cocos nucifera, the coconut palm.

These natural conditions produce coconuts with thicker flesh, which will have richer and creamier coconut milk.

Today, coconut remains Perak’s second most important agricultural commodity after rice, reported Bernama.

According to the latest data from the Perak Agriculture Department, Bagan Datuk contributed nearly 90% of Perak’s coconut production or about 12% of Malaysia’s total supply, making it the country’s third largest producer after Selangor and Johor.

Coconut cultivation is a way of life in Bagan Datuk, practised by almost every household.

From small home plots to commercial plantations, Perak folk are growing modern hybrid varieties such as the Malayan Tall and Matag.

A worker plucking coconuts from a tree at the plantation in Bagan Datuk.

A worker plucking coconuts from a tree at the plantation in Bagan Datuk.

Sweet coconut water

According to coconut grower and wholesaler Abdul Aziz Mokhtar, 50, the Matag variety is usually grown for both coconut water and coconut milk, while the taller Malayan Tall variety is more commonly cultivated for milk production.

“Some smallholders still plant the old varieties, what people call kelapa kampung or Malayan Tall and harvest a mix of old and young coconuts mainly for coconut milk,” he said.

Matag F1, he said, was relatively new to local farmers, introduced around five to six years ago by the Agriculture Department to improve yield and quality.

“Malayan Tall trees are known for longevity and stable yields, while Matag palms grow faster, produce more and stay shorter.”

“Matag trees can be planted more densely – about 70 trees per 0.4ha compared to 60 for Malayan Tall – because they are shorter and their fronds don’t spread as widely,” he added.

With more than 20 years experience in coconut farming, Abdul Aziz noted that research by the Agriculture Department and the Malaysian Agricultural Research and Development Institute (Mardi) has significantly improved coconut varieties.

“In the past, we only had the traditional local varieties, but over the past decade, new types like Pandan, Matag F1 and SGG have emerged,” he said.

The main advantage of the new types, he said, was speed.

“These new varieties mature faster – you can start harvesting in just three to three-and-a-half years.

“The older Malayan Tall or village varieties take seven to eight years to bear fruit, which is not commercially viable today,” he pointed out.

In August, Mardi announced the development of four new hybrid varieties, namely the Mylag, Marleca, Careca and Careni, which are capable of producing up to 25,000 coconuts per hectare annually.

Abdul Aziz says the Matag F1 is a relatively new type to the local farmers.

Abdul Aziz says the Matag F1 is a relatively new type to the local farmers.

Strong economic potential

A farmer’s income depends on the variety planted and the size of the farm, with some seeing returns as early as three to four years after planting.

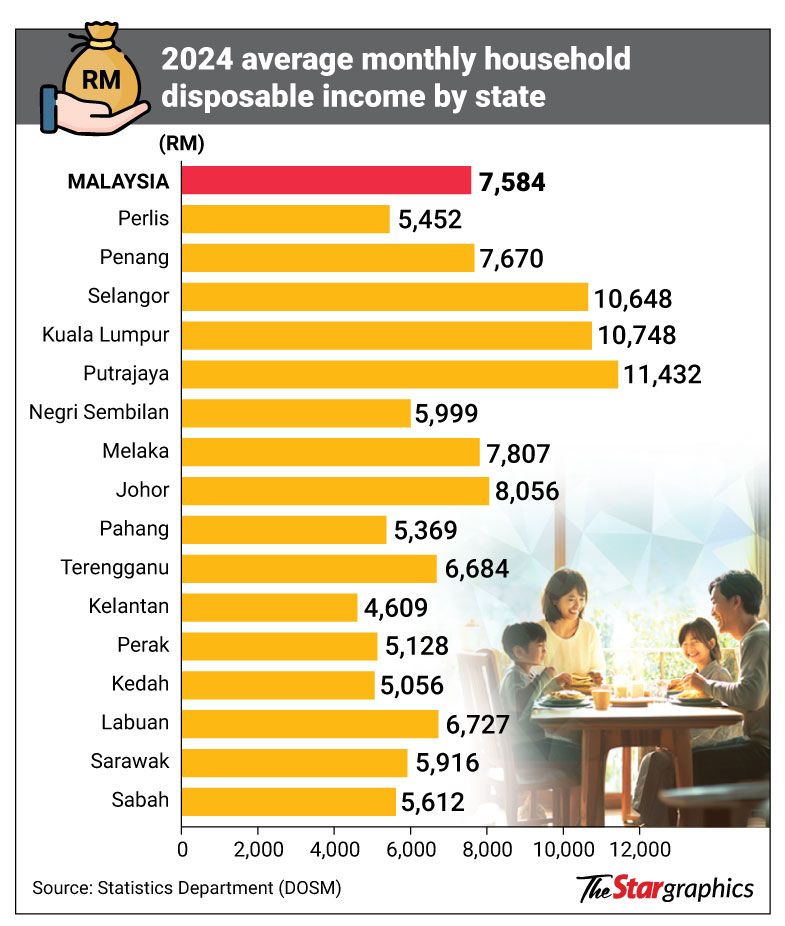

On average, a grower tending two hectares can earn between RM2,000 and RM2,500 per month, based on an average price of RM1 per coconut.

Beyond selling fresh coconuts or coconut milk, many smallholders also produced value-added products such as kerisik and virgin coconut oil among other coconut-based goods.

Based on his experience engaging with foreign entrepreneurs at seminars and workshops, Abdul Aziz believes Malaysia has strong potential to become a coconut-exporting nation, but only if production stabilised.

“China is very interested in importing coconuts from Malaysia.

A coconut plantation worker in Bagan Datuk collected a bunch of Matag coconuts. - Bernama

A coconut plantation worker in Bagan Datuk collected a bunch of Matag coconuts. - Bernama

“Inconsistent supply remains the biggest barrier.

“If they request one million coconuts and we cannot deliver, it becomes a major issue,” he said.

He believes that once production challenges are addressed, Bagan Datuk can become a major global supplier, bringing significant economic benefits to local communities.

Youths returning home

As urban job markets become increasingly uncertain, more young people are returning to their hometowns to pursue agriculture, including coconut farming which offers a stable income potential.

For young people with access to family land, even over a 1.2ha is enough to generate side income.

Properly maintained, every 0.4ha can yield about 800 young coconuts per month, bringing in around RM800.

It has now become a trend among the district’s youth – farming on their own, managing family plots or even helping relatives, despite having full-time jobs.

One of them is Syamsul Bahri Imam, 38, who previously worked in building maintenance. He returned to his village to continue his late father’s coconut farming legacy.

“I took over when my father fell ill, and continued the work after he passed away.

“People used to think coconut farming was an old man’s job, but now many young people are interested. Some are continuing their fathers’ work, others are starting from scratch,” he said.

Syamsul said city life was expensive and that earning RM3,000 in the city may not be enough, but RM2,500 in the village was comfortable.

“You have your own home, food is cheaper and government support like fertiliser and pesticide subsidies help a lot.”

Still, he notes that challenges remain, such as pests especially monkeys, which frequently target coconut farms.

Government commitment

Perak Agriculture Department director Norsiyenti Othman said both the state and Federal governments have channelled targeted allocations through programmes such as the New Planting Programme and Rehabilitation Programme to support coconut farmers.

“To strengthen the direction of the coconut industry, the Perak Agriculture Department received RM1.26mil in allocations from the state and Federal governments,” she said.

The funds covered agricultural development, training and small-scale agro-based industry (IAT) programmes, she added.

Bagan Datuk district remains the state’s leading producer with 80,029 tonnes followed by Manjung (4,192 tonnes) and Kinta (1,718 tonnes).

The state’s coconut industry continues to grow, achieving a Self-Sufficiency Level (SSL) of 141%.

Norsiyenti said output increased to 89, 978 tonnes across 7,478ha in 2024, driven by replanting and rehabilitation efforts.

Under Perak’s coconut development initiative, two main sub-programmes are implemented.

One of it is new planting and replanting incentives that include land clearing, removing old trees, site preparation, hole-digging, fencing and installation of irrigation and drainage systems.

Farmers also receive inputs such as fertilisers, pesticides, tools and certified seedlings.

The second one is rehabilitation of existing farms, where participants receive similar agricultural inputs to restore productivity on older farms.

In 2024, a total of 61.01ha were covered under both programmes, benefitting 40 recipients who collectively produced 420 tonnes of coconuts worth RM546,000.