https://youtu.be/a_B80AIQegE

Owning a house is the standard ambition of any individual, however, getting there is increasingly becoming not only a local, but global struggle. |

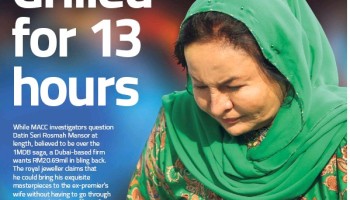

Harking after a home: Officials have

acknowledged that the lack of affordable housing is one of the issues

that sparked the unrest in Hong Kong, which has been going on for

months. — AFP

|

THERE’S a lesson to be learnt from the protests in Hong Kong – politics is about selling hope. So if the young people living in a depressing environment feel they have no future, then the alarm bells should ring loudly.

In the case of Hong Kong, the leaders – mostly technocrats and government officials – didn’t see it coming, or maybe they were just indifferent.

Many young people in Hong Kong feel they stand no chance of becoming a homeowner in their lifetime, and officials have acknow-ledged that the issue is one of the causes that sparked off the unrest.

The controversial Extradition Bill, which allows a Hong Kong resident to be sent to mainland China to face trial, was merely a catalyst. Those protesters couldn’t all possibly believe they’d fall on the wrong side of the law and face the consequences, could they?

Last week, former Hong Kong chief executive Leong Chun-ying was in Kuala Lumpur for appointments with businessmen, opinion leaders and officials, to update them on developments on the island.

I was among the lucky Malaysians picked to hear his thoughts and views on Hong Kong, while he, too, listened to our concerns during the two-hour closed-door meeting.

My co-host and meeting organiser, Datuk Seri Azman Ujang, and I both feel that of all the problems faced by any country in nation- building, none deserves greater priority than housing the people.

What expectation could be more basic than having a roof over our heads, and with it being a decent and affordable one at that? And when we talk about affordable, it should be truly attainable by the low-income people who form the bulk of the population in most countries.

Azman, the Bernama chairman, rightly outlined the consequences of the failure that stems from a lack of will in resolving the housing problem of the masses. And as he said, this could easily lead to people pouring into the streets protesting issues not even directly related to housing.

It’s a fact that many poor Hong Kong people live in a room less than 75sq ft, and millions live in deplorable conditions.

More recently, “nano” flats – tiny apartments less than 200sq ft – have fast become the norm in overcrowded Hong Kong.

According to a South China Morning Post report, the cost began at HK$2.85mil (RM1.52mil) for an apartment no bigger than an average Hong Kong car park space, but the lack of interest forced a rethink by the developer.

But what’s mind-boggling is that while there are plenty of poor people in Hong Kong, or many who feel poor, Hong Kong’s fiscal reserves stood at HK$1.16tril (RM620bil) as at the end of January.

In a report, Financial Services and the Treasury Bureau said there was a surplus of HK$86.8bil (RM46.2bil), bringing the cumulative year-to-date surplus up to HK$59bil (RM31bil).

All this wealth belongs to Hong Kong and not mainland China, so a lot can be done with that money for a population of just seven million people, especially low-cost housing!

In comparison, Malaysia’s official reserve assets amounted to US$102.03bil (RM425bil) as at end November 2018, while other foreign currency assets stood at US$51.6mil (RM215mil) for the same period, Bank Negara said. Malaysia has a population of 32 million.

It can’t be denied that Singapore has done well in housing its population, with over 90% of the seven million population reportedly living in homes of their own, and the home-ownership ratio is said to be the world’s highest.

The Singapore Housing Development Board (HDB) deserves global recognition for its feat in solving the housing problem of the people, especially the poor.

The middle-class and poor must be able to have a roof over their heads. That’s an essential human need. No country can have peace and stability if the poor are not able to own a home in their lifetime.

A prosperous and satisfied middle-class will lead to political stability. A huge middle class will also mean greater purchasing power, and this will lead to a better economy with spillover effects for everyone.

When there are angry citizens protesting everything from the escalating food prices to housing, then even the elite (including politicians and businessmen) will not feel safe. In South Africa, the rich live in houses with high walls and electric fences to protect themselves, but that’s not the best way to live. It’s living dangerously.

Malaysian politicians who still wield the race and religion card will realise that at some point, these will be “dead issues”.

With well-documented shrinking numbers, the Chinese and Indian population will no longer be the proverbial bogeymen in the future. Instead, it is class stratification that will be a matter of concern.

Last year, it was reported that the gap in income between the rich, middle class and poor in Malaysia had widened since 2008, according to a study by Khazanah Research Institute (KRI).

In its “The State of Households 2018” report, the research outfit of sovereign wealth fund Khazanah Nasional Bhd noted that the gap in the real average income between the top 20% households (T20) and the middle 40% (M40) and bottom 40% (B40) households had almost doubled, compared to two decades ago.

The report, titled Different Realities, pointed out that while previous economic crises, in 1987 and the 1997/98 Asian Financial Crisis, saw a reduction in the income gap between the T20 and B40/M40, post-2008/09 Global Financial Crisis (GFC), those disparities had not reduced.

But the Gini coefficient, which measures income inequality in the country, had declined from 0.513 in 1970 to 0.399 in 2016, denoting improvement in income inequality in Malaysia over the past 46 years.

Explaining the phenomenon, Allen Ng, who is the lead author of the KRI report, said income of the T20 households had continued to grow, albeit at a slower pace than that of the M40 and B40 since 2010.

“However, because they (the T20) started at a higher base, the income gap between the T20 and M40/B40 had continued to grow despite the fact that the relative (income growth) is actually narrowing post-GFC, ” Ng explained at a press conference after the launch of the report yesterday.

In his bestselling book The Colour Of Inequality: Ethnicity, Class, Income And Wealth In Malaysia (2014), economist Dr Muhammed Abdul Khalid wrote that “the future does not look rosy for Malaysia; the current policies are encouraging wealth disparity between rich and poor, and between ethnicities.

“Unless bold and drastic actions are taken urgently, a harmonious future for Malaysia is uncertain. There must be an urgency to give every Malaysian economic security, a better and sustainable future.”

Muhammed, the managing director of the research and consulting firm DM Analytics Malaysia, said last year that contrary to popular belief, most Chinese (70%) are wage-earners, as are most Malays (72%). In fact, the poverty gap between races has dropped compared to 40 years ago, though the disparity remains.

And what about Malaysia? We have a disastrous, if not scandalous, record, particularly the pathetic business activities, dealings and performance of the 1Malaysia People’s Housing Programme’s (PR1MA) set up to build affordable homes.

More than RM8bil has gone up in smoke because PR1MA’s management failed to meet its targets, despite all the assistance and facilities accorded to their projects by the previous federal government and most state governments.

PR1MA reportedly built only 11,000 homes, compared with its target of half a million residential units to be delivered by the end of 2018. That’s less than 5% of the original plan.

PR1MA Malaysia was set up to plan, develop, construct and maintain high-quality housing with lifestyle concepts for middle-income households in key urban centres. Its homes are priced between RM100,000 and RM400,000.

PR1MA is open to all Malaysians with a monthly household income of RM2,500 to RM15,000.

A total of 1.42 million people registered for PR1MA, a promise of one million homes by 2020, but only 16,682 units, or 1.6%, of the target, were completed between 2013 and 2018, costing the government billions in public funds.

Poor management, exorbitant land acquisition costs and unsuitable sites have turned the people’s housing project into a major financial flop. PR1MA’s failure, which could cost the new government billions, is apparently already saddled with ballooning debts, rendering the loss-making company untenable.

It’s the responsibility of the government to build affordable homes – not the private developers. Private developers, especially those who helm public listed companies, have profits and dividends to answer for to shareholders. They are in the business of making money, and with the expensive land bank they have acquired, they need to build expensive homes, too.

Even if there are requirements with the obligated mixed homes for social housing needs, it still won’t resolve the problems.

Our politicians shouldn’t pass their responsibilities to them. They just need to have qualified and competent professionals with integrity to run a set-up like HDB. Obviously, the people who ran PR1MA didn’t do their jobs. We can help Malaysians own homes, or at least rent them at affordable rates, if we’re truly committed. The question is, are we?

As for Hong Kong, there is another lesson the young protesters need to learn: a full democracy doesn’t guarantee you a home and a decent job. Just ask the homeless in the United States and Britain.

Source link

Read more:

Abolish RPGT to avoid penalising non-speculative ..

Property wish list for Budget 2020 | The Star Online

Property wish list for Budget 2020 | The Star Online