This visual is human-created, AI-aided.

AI used to gather sound metadata to clone voices

PETALING JAYA: Silence is golden. This is exactly what one should do to avoid becoming a victim of the latest AI-generated silent call scam, says the Malaysian Communications and Multimedia Commission (MCMC).

A recent video released by Friends of MCMC warning of the latest tactic used by scammers saw several Malaysians coming forward to relate their personal experiences.

Sean Ang, 34, a data analyst from Kuala Lumpur, said he grew suspicious of phone calls from unknown numbers recently.

ALSO READ: Stay smart and be suspicious of scammers

“The calls would come in but there would be no one speaking on the other side.

“Fortunately, I was aware of the latest scam and had also read about how scammers are using AI to dupe people in Thailand.

ALSO READ: Chasing easy money leaves victims with big losses

“When I get such calls from unknown numbers, I will remain silent and hang up if no one is on the other end,” he said when contacted yesterday.

Sabahan Francis Magawun, 43, currently working in Petaling Jaya, said he received calls from unknown local mobile numbers and overseas phone numbers.

“I am a sceptical person by nature and wary of getting unknown calls even before the recent warning issued by the MCMC.

“If I get such calls, I remain silent to see if there is any response before hanging up,” he said.

Magawun is concerned that senior citizens may fall prey to such scams as they are not aware of evolving online threats, particularly those using AI technology.

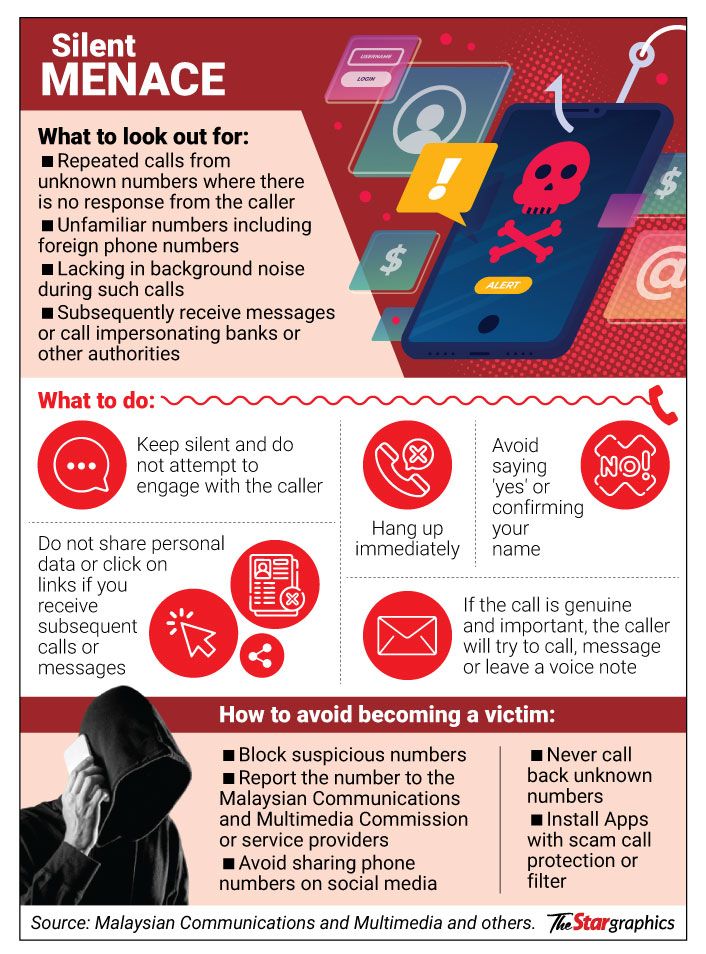

The silent call is a tactic used by scammers to phish for victims. It begins with ringing up the target, but the caller deliberately leaves the line silent when the call is answered.

By answering, a person is deemed to have an active number and is placed on a target list for scam messages or calls impersonating banks or other authorities.

If the target answers, his voice is recorded and later cloned with AI for impersonation purposes.

The MCMC had recently posted a two-minute video on social media to warn Malaysians that AI technology is being used to gather sound metadata to clone voices.

The AI-cloned voice is then used to scam the target’s family by requesting help due to an emergency, to get a company staff member to transfer money or to by-pass voice verification used by certain commercial institutions.

Mohamed Hussain Rasool Mohd became more alert after reading a warning posted on the Penang Community Facebook page of such modus operandi.

Kaizen Sun, in a posting in the same Facebook page, said those who answered a silent call would usually get follow-up calls the very same day and for the next several days.

“All sorts of numbers – local, mobile and international.

“There was even one WhatsApp text message telling me that he was my long-lost contact from wine trading (and I’m wondering in which lifetime was I involved in the alcohol business),” the post read.

.jpg)