China's challenger to Airbus and Boeing's passenger jets, the narrowbody C919, made its international debut in Singapore on the eve of opening day of its air show. It comes after Chinese planemaker Commercial Aircraft Corporation of China (Comac) signalled an interest in gaining a bigger foothold in the aviation market in 2024.

Singapore Airshow, starting point for C919 to step onto world stage: Global Times editorial

Chinese-made craft takes flight | The Star

China's homegrown C919 secures biggest-ever aircraft order

China Eastern Airlines has signed a purchase contract with Commercial Aircraft Corporation of China, Ltd. (COMAC) for an additional 100 C919 planes, marking the largest single order for the China-developed large passenger aircraft.

According to the plan, the new C919 aircraft purchased by the airline company will be delivered in batches from 2024 to 2031.

China Eastern Airlines placed an order for five C919 planes in 2021. The company has taken delivery of two jets and put them into operation on the air route between the cities of Shanghai and Chengdu.

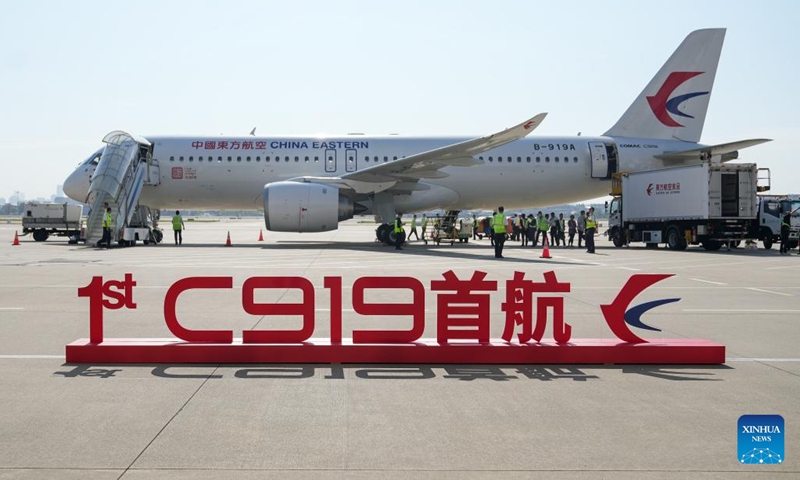

China's C919 passenger plane completes inaugural

commercial flight, showing China's efforts in self-innovation in high-end manufacturing industry

This photo taken on May 28, 2023 shows a C919, China's self-developed large passenger aircraft, getting ready for its first commercial flight in east China's Shanghai. C919 kicked off its first commercial flight from Shanghai to Beijing on Sunday, marking its official entry into the civil aviation market. (Xinhua)

C919, China's self-developed large passenger aircraft, completed its inaugural commercial flight from Shanghai to Beijing on Sunday, creating a milestone in China's aviation industry, which aims to compete with global players such as Boeing.

Developed by Commercial Aircraft Corporation of China (COMAC), the C919 aircraft, China's first self-developed large jet airliner, is important proof of China's strength in self-innovation in the high-end manufacturing industry, and its solid market performance will foster further confidence in future orders and among customers, Chinese experts said.

The C919's inaugural flight departed at 10:32 am from Shanghai Hongqiao International Airport and landed at Beijing Capital international Airport at 12:31 pm, where it was welcomed with a special water-salute ceremony.

The highly anticipated flight, codenamed MU9191 flying from Shanghai to Beijing was flown by China Eastern Airlines, and carried around 130 passengers.

"More than 20 years ago, I heard many people in the aviation field talking about their dream of making a big plane. I am so excited to be one of the first passengers to fly on the C919," a passenger named Shi Ding told the Global Times on Sunday.

Shi said he arrived at the Shanghai airport at 7:40 in the morning, and there were around 500 people attending the inaugural ceremony. "I have been closely watching the development of C919 for years. As an aviation fan, I am so proud that China now has such an advanced aircraft manufacturing industry."

The video clips he sent to the Global Times showed passengers waving national flags and the cabin filled with a euphoric atmosphere, with excited passengers taking photos and shooting videos. The carrier even prepared meals selected by poll by the passengers.

Both the business and economy class on the C919 use a new generation of domestically designed and produced cabin seats. Among them, eight business class seats use an all-aluminum alloy frame structure with a cradle design and a backrest that can reach 120 degrees. The distance between the front and rear seats exceeds 1 meter.

The C919 cabin has an aisle height of 2.25 meters, and the middle seat in the economy class triple seat is 1.5cm wider than the two seats on the end, bringing passengers more comfort.

The C919 project was launched in 2007 and completed its first test flight in 2017. On September 29, 2022, it obtained the Type Certificate from the Civil Aviation Administration of China, the country's aviation sector regulator.

With between 158 and 168 seats, and a flight range of 4,075 to 5,555 kilometers, the C919 is designed to have the same level of specifications as the popular Airbus 320 and Boeing 737.

According to China Eastern Airlines' plan, the first C919 plane will initially be operated between Shanghai and Chengdu, capital city of Southwest China's Sichuan Province, before flying more routes.

China Eastern has also set up special teams including cabin services to ensure security and guarantee services.

New starting point

"Based on earlier full preparations, the maiden flight is a new starting point for China Eastern," Li Yangmin, vice chairman of the Shanghai-based China Eastern Airlines Corp, was quoted as saying at the inaugural ceremony held in Shanghai on Sunday.

Li said the airline will take this commercial operation as an opportunity, and strive to meet market demand with high-quality supply, allowing people in China and even around the world to use the plane.

Before the flight, other Chinese airlines also expressed interest in the plane. On Thursday, Ma Chongxian, chairman of Air China Ltd, said that in 2010 the company signed a purchase agreement with COMAC for 20 C919 aircraft, and continued to pay attention to the progress of the C919.

China Southern Airlines vice chairman Han Wensheng said on the same say that his company is paying great attention to the C919 aircraft and maintaining close communication with COMAC.

COMAC said in January that the company expects to reach an annual production capacity of 150 C919 planes within five years, and has already received more than 1,200 orders, according to media reports.

Chinese experts said that the commercial fight is of great significance to China's equipment manufacturing industry, as the civil aircraft manufacturing industry is a symbol of a country's technological and industrial strength.

For China's aviation manufacturing industry, China's commercial aviation must have its own place in the world, in terms of not only market size and development potential, but also equipment manufacturing, Wang Ya'nan, chief editor of Beijing-based Aerospace Knowledge magazine, told the Global Times. "We must have our own manufacturing capabilities for regional aircraft and large commercial airliners," he noted.

We should focus on core technologies in key fields and continue to work together to tackle bottleneck problems, we must put safety and reliability first and eliminate all potential hazards, and we must do a good job in the large aircraft sector, said China's top leadership at the end of September last year that when the C919 passenger jet was issued the type certificate by China's civil aviation regulator, according to the Xinhua News Agency.

COMAC, the developer of the plane, extended its warm congratulations over the flight on its WeChat account with a line from an ancient poem that translates as "Till the day the strangled dragon vibrates in fresh rainfall, it will surely roar to the sky like a flying crane."

Photo: Courtesy of China Eastern Airlines

Global competitionHours after the conclusion of the inaugural commercial flight, global plane manufacturers sent messages of congratulation.

"On the occasion of the successful commercial maiden flight of C919 today, we would like to extend our sincere congratulations to China Eastern Airlines and COMAC," Boeing said on its official WeChat account, while Airbus also sent warm congratulations to China Eastern Airlines C919 on successfully completing its first commercial flight.

In an earlier interview with Global Times in April, Airbus CEO Guillaume Faury said that COMAC has brought new competition to the market. "We have great respect for any competitor in the market," he said.

The C919's first commercial flight means that China's extraordinary aviation capabilities have started to accept the challenges of the market, Qi Qi, an independent market watcher, told the Global Times on Sunday.

With the accumulation of flight hours, there will be more confidence in potential orders and among customers, as well as more growth in the entire large aircraft industry chain, Qi remarked.

A market forecast report released by COMAC in 2021 predicted that China's aviation market will receive 9,084 passenger aircraft with more than 50 seats over the next 20 years, with a value of about $1.4 trillion. It is widely believed that a trillion-dollar level aircraft industry chain is gaining momentum with the commercialization of the C919.

As for future flights, Qi said it is still too early to talk about exploring the international market at this stage.

Prior to this, it is necessary to obtain airworthiness certifications from the civil aviation authorities of other countries, and obtaining the type certification from Federal Aviation Administration and European Union Aviation Safety Agency will be an important indicator of how the C919 will explore the international market, Qi said.

It has been predicted that the C919 will still face many difficulties amid a changing international political backdrop, and the difficulties may be even greater than expected. As a strategic project of China's national aviation industry, the goal of the C919 will not waver, Wang said. China will mobilize and pool all its scientific research and industrial resources to push this project to a successful end.

"For a developing country like China, which is under enormous development pressure, we have no other choice but to face up to the difficulties," Wang noted.