India and China come down hard due to concerns of financial market stability, illegal fundraising

N THE latest twist involving the world of cryptocurrencies, India’s government plans to impose a massive ban on the asset class.

Reports have indicated that the Indian government plans to pass a bill that would ban just about every activity involving cryptocurrencies, including the possession, issuance, mining, trading and the transferring of crypto-assets.

Once passed, this would make it one of the world’s strictest policies on cryptocurrencies. Government officials have said that the move is because they believe cryptocurrencies threaten the stability of financial markets, tend to fund unlawful activities and even resemble ponzi schemes.

The move by the Indian government falls in line with the school of thought that cryptocurrencies could increasingly suffer bans by governments around the world.

In India’s case, the move comes after an earlier ban two years ago. But last year, the courts in India overturned the decision, citing the ban as “disproportionate” after cryptocurrency exchanges filed a lawsuit against the central bank’s ban.

The strong stance against cryptocurrencies has also been shown by China’s government. More than three years ago, China was the first country to ban initial coin offerings (ICOs), calling it “illegal fundraising”.

Since then, the Chinese government has accelerated efforts to clamp down all businesses involved in cryptocurrency operations, including bitcoin miners.

China’s government says its stance is based on investor protection, money laundering concerns and the unnecessary consumption of energy due to crypto mining activities.

Last month alone, there were plans to ban new cryptocurrency mining projects and shut down existing ones in China’s Inner Mongolia region.

As one financial analyst puts it, “the problem with cryptocurrencies is that while it thrives to work in an unregulated world, it is bound to come under the scrutiny and regulation of governments, which are mostly afraid of its misuse and potential negative impact to financial markets. Perhaps somewhere in the future, a balance will be struck but that is anyone’s guess”.

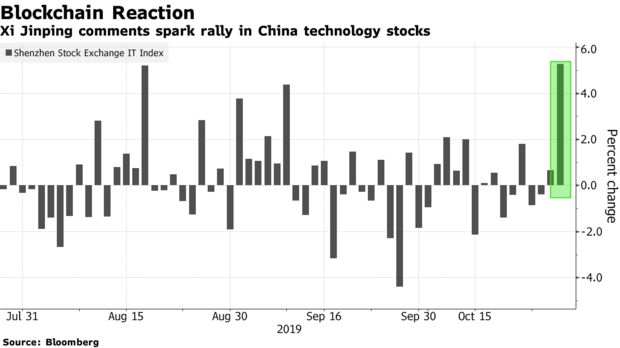

While governments have a tendency to ban cryptocurrencies, many are embracing blockchain technology with the intention of issuing state-backed digital currencies.

This is essentially an electronic version of notes or coins which would replace physical cash entirely and dubbed central bank digital currencies or CBDC.

China is one of the leading countries for this and has already passed a law to legalise its own official digital currency. Similarly, India is an example of another country that is considering having its own digital currency. Interestingly, India’s move to pass the bill to ban cryptocurrencies comes soon after the mother of all cryptos, namely, bitcoin has hit its all-time high past US$60,000 (RM246,449) for the first time earlier this week.

The world’s biggest currency rally was driven by speculative demand, increased adoption by firms and institutional investors that see bitcoin as a store of value. Last month, Tesla bought over a billion dollars worth of bitcoins.

The electric car maker said it plans to accept the digital coin as payment for its products. Mastercard has also said it would also soon accept bitcoin as a form of payment.

Asset manager BlackRock and payment companies Paypal and Square have also recently backed cryptocurrencies.

Back home, the question remains whether the government, central bank or the Securities Commission (SC) would take a stronger stance against cryptocurrencies.

Malaysia’s regulators have held the view that digital assets are not legal tender and have warned investors to be cautious when dealing with cryptocurrencies.

SC chairman Datuk Syed Zaid Albar tells StarBizWeek that “investors must understand that unregulated, offshore investments are not protected under Malaysian securities law”.

“The SC has put in place a regulatory framework for such new emerging investment channels to provide certainty to issuers and investors who are keen to explore these new instruments.

“For example, our regulatory framework has tried to address issues such as putting investors’ money in trust accounts, accurate disclosures, cooling-off periods and conflict of interest situations are also regulated, ” Syed Zaid explains.

The country’s central bank, Bank Negara, also echoes a similar view, explaining that digital assets lack the characteristics of money and suffer from several limitations such as price volatility and risks of cyber threats.

“Digital asset activities are also subject to anti-money laundering and counter-terrorism financing regulations administered by the respective authorities, ” the central bank reported in its annual report in 2019.

Malaysia is also one of the countries studying the feasibility of issuing its own digital currency. “The bank is no exception, and we continue to engage closely in discussions surrounding CBDC with other central banks, ” it said.

More collaborations among central banks around the world are taking place to study the impact of a digital currency for financial stability and the monetary policy of a country.

Why does Bitcoin use 10 times more electricity than google...

Google’s entire operation consumed 12.2 TWh in 2019 and all the datacentres in the world, excluding those that mine Bitcoin, jointly consume around 200 TWh annually. — Reuters

Related posts:

Blockchain: Internet of Value/ Currency of Trust; Private cryptocurrency a misallocation among blockchain technology, say research & economist

China gets into blockchain race with US

China's new digital currency

On Mcoin, Bitcoin and points of investment

Bitcoin: Utter pipedream

Blockchain Festival & Conference Week, Kuala Lumpur 26~27 Sept 2018