PETALING JAYA: Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz is presenting Budget 2021 in the Dewan Rakyat, the first under Prime Minister Tan Sri Muhyiddin Yassin’s administration.

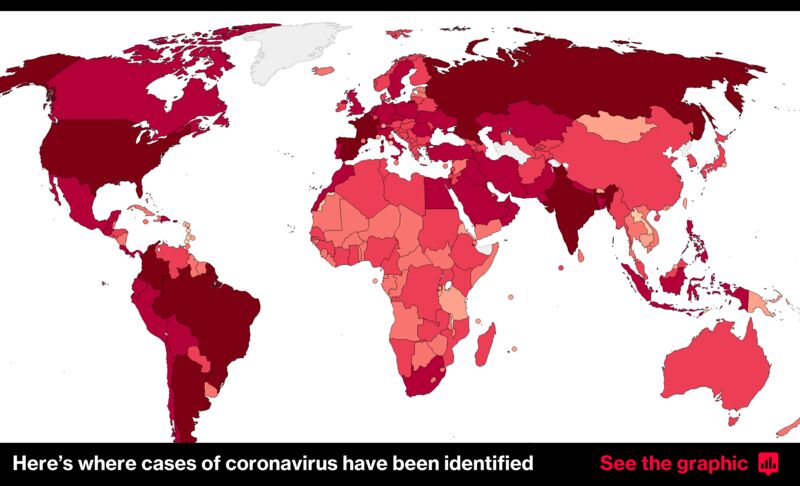

Budget 2021 is widely expected to be one of the biggest, if not the biggest federal budget to date, as it contains many measures to help ordinary Malaysians and to stimulate economic recovery in the midst of the Covid-19 pandemic.

Follow the developments below:

Updating...

Special finance aid for civil servants

The government announced a special finance aid worth RM600 for civil servants grade 56 and below. For pensioners and veterans with no pension, a special financial aid of RM300 will be given. Both aids will be paid out early 2021.

Vapourising vaping

Excise duty at an ad valorem rate of 10% on all types of electronic cigarette devices and non-electronic devices, including vaping products.

Electronic cigarette liquids will also be subjected to an excise duty at a rate of RM0.40 per millimetre.

More savings for households

SAVE 2.0 programme will be introduced, where an e-Rebate of RM200 for a household purchasing a locally made air-conditioning unit or refrigerator. RM30mil has been allocated for the programme, and it would benefit 140,000 households.

Duty-free doom for ciggies

Beginning January 2021, no more new cigarette import licences will be issued. Such licence renewals will also be tightened and the conditions revised, including imposing import quotas.

The transhipment of cigarette exports will be limited to selected ports. Taxes will be imposed on drawbacks on all imported cigarettes for the purpose of transhipment and re-export.

The government will also not allow transhipment activities and re-exports of cigarettes using pump boats.

Taxes will also be imposed on cigarettes and tobacco products at all duty-free islands.

↓

Towards cleaner rivers

RM50mil will be allocated to tackle rubbish and solid waste in rivers,

Education Ministry gets biggest allocation

The Education Ministry will receive the biggest allocation with RM50.4bil or 15.6% of the total budget.

Task force beefed to battle smuggling

The Multi-Agency Task Force will be empowered with the inclusion of the Malaysia Anti-Corruption Commission (MACC) and National Anti-Financial Crime Centre to battle smuggling of high duty items.

When the levy breaks

To help reduce the cashflow burden of still-affected companies, a Human Resource Development Fund (HRDF) levy exemption will be given for six months effective Jan 1, 2021. This exemption will cover the tourism sector and companies affected by Covid-19.

Indigenous inspiration

To ensure the wellbeing of the Orang Asli community, RM158mil has been allocated.

This will be channelled to social assistance and development programmes.

A total of RM5mil has been allocated for surveying work to mark the borders of 21 villages.

Another RM41mil has been allocated for a Native Customary Rights programme in Sabah and Sarawak.

Assistance for contractors

RM2.5bil will be allocated to Class G1 to G4 contractors to carry out small and medium projects nationwide. This will include RM200mil for Federal road maintenance and RM50mil for the maintenance of People's Housing Program housing units.

Special grant for Sabah traders

The government has heard about the plight of the traders and hawkers in Sabah who were greatly affected from the reduced presence of tourists. Thus, an additional Prihatin Special Grant (GKP) of RM1,000 will be given to traders and hawkers in Sabah. This special grant will also be given to taxi drivers, e-hailing drivers, car rentals and tourist guides in Sabah.

Equity crowdfunding boost

To encourage more individual investors to participate in equity crowdfunding (ECF) platforms, an income tax exemption of 50% from the invested amount or limited to RM50,000 will be given.

RM30mil is allocated to a matching grant that will be invested into ECF platforms under the supervision of the Securities Commission.

Preparing for tourists

To ensure the readiness of tourist hotspots, RM50mil is prepared for the maintenance and repairs of tourism facilities all over the country. RM20mil has also been allocated for improving the infrastructure and spurring the promotion of Cultural Villages in Terengganu, Melaka, Sarawak and Negeri Sembilan.

Healthcare help

RM35mil allocated to the Malaysia Healthcare Travel Council to increase competitiveness in the local health tourism sector.

The government will also extend the tax exemption for private healthcare service exports until 2022.

Micro credit financing

Micro credit financing of almost RM1.2bil will be made available through Tekun, PUNB, Agrobank, BSN and other financial institutions. This includes an additional RM110mil to the Micro Enterprises Facility under Bank Negara to encourage entrepreneurship activities among gig workers and those who are self-employed as well as to support the iTekad implementation programme.

Preserving heritage buildings

RM10mil will be allocated to ensure heritage buildings such as Bangunan Sultan Abdul Saad and Carcosa Seri Negara will be maintained and become tourism icons.

More child care centres at government buildings

To improve the support system for frontliners and working parents, RM30mil has been allocated for the setting up of child care centres at government buildings, especially hospitals. Another Rm20mil has been in grants will be allocated to the private sector to encourage them to set up similar centres.

Locals and Orang Asli as tourist guides

Employment opportunities will be provided to 500 people from the local community and the Orang Asli as tourist guides at all national parks to spur the ecotourism segment.

Help for airline staff

The government recognises that the tourism industry, especially airline companies, are among the most affected sectors. Thus, the government will provide training programs and relocations for 8,000 staff from airline companies in Malaysia, with an allocation of RM50mil.

Boost for palm oil sector

The Malaysian Sustainable Palm Oil (MSPO) Certification Scheme will be continued with RM20mil to boost the growth of the country's palm oil sector. A matching grant of RM30mil to encourage investments will be introduced.

Social support centre for women

To combat the issue of domestic violence, the government will set up a social support centre with an allocation of RM21mil. With the help of NGOs, the centre will provide social and moral support for women, especially those facing domestic violence and divorce.

Promoting Malaysian-made goods

RM35mil will be allocated to promote Malaysian-made goods and services under the trade and investment mission.

Supporting the production of local products

The National Development Scheme (NDS) worth RM1.4bil will be allocated to support the implementation of domestic supply chain development and increase the production of local products such as medical equipment.

Safety net

RM24mil has been allocated for a Socso disaster scheme that is expected to benefit 100,000 workers, including delivery drivers and contractual civil service workers.

Contribution to battle Covid-19

Four glove manufacturers - Top Glove, Hartalega, Supermax and Kossan have committed to contribute RM400mil to battle Covid-19, including bearing the cost of the Covid-19 vaccine and health equipment.

<Encouraging high tech and innovative sector Encouraging high tech and innovative sector

RM500mil High Technology Fund will be provided by Bank Negara to support high tech and innovative sector companies.

EPF withdrawal for insurance purchase

The Employees Provident Fund (EPF) will allow its members to withdraw from their Account 2 to purchase insurance products for themselves and their family members. The Private Retirement Scheme (PRS) tax relief of RM3000 a year has been extended until 2025.

RM1bil will be provided as a technology and high value investment incentive package.

Allocation for Defence Ministry and Home Ministry

The Defence Ministry and the Home Ministry will be allocated RM16bil and RM17bil, respectively.

Improving cyber security safety

RM27mil will be allocated to CyberSecurity Malaysia to improve the cyber security safety of the country.

Laptops for online classes

To ensure students at higher learning institutions (IPT) on PTPTN loans are able to follow online classes, the government will work with BSN to ready RM100mil to finance Skim BSN MyRInggit-i COMSIS, a laptop computer loan scheme.

Unlimited pass, and beyond!

The My30 Unlimited Travel Pass initiative will be continued and further implemented in Penang and Kuantan with an overall allocation of RM300mil.

An unlimited monthly travel pass at RM5 will be introduced to students from Year One to Form Six, as well as disabled students.

Tax relief for parents saving for their children's future

To encourage parents to save for the costs of their children’s higher education fees, a tax relief of up to RM8.000 for National Education Savings Scheme (SSPN) net savings will be implemented until assessment year 2022.

Tourism aid

The wage subsidy programme will be extended for another three months, in a targeted manner especially for those in the tourism sector. Altogether, RM1.5bil has been allocated, with an estimated 70,000 employers and 900,000 workers expected to benefit.

Creating jobs

A short-term employment programme MyStep with an allocation of RM700mil will offer 50,000 contractual job opportunities in the civil service and government linked companies (GLCs) from January 2021.

Under this initiative, 35,000 jobs in the civil service will be offered, with a priority given to vacancies such as nurses and medical attendants. The GLCs will provide 15,000 jobs with a priority on technical and financial fields.

Better infrastructure in public universities

Some RM14.4bil will be allocated to the Higher Education Ministry. This would include RM50mil to repair infrastructure and old equipment in public universities.

Stamp duty exemption for first home owners

Full stamp duty exemption will be given to transfer of ownership document and loan agreement for the purchase of a first home worth not more than RM500,000. This exemption will be for the purchase agreement from January 2021 to Dec 31, 2025.

Stable internet connection in universities

To ensure stable internet connection in tertiary education institutions, the government has allocated RM50mil to upgrade the Malaysian Research and Education Network (MYREN) access from 500Mbps to 10Gbps.

Free laptops for students

In the new normal, online learning has become an everyday practice. GLCs and GLICs will contribute RM150mil to Tabung Cerdik to give laptops to 150,000 students at 500 schools in a pilot project. The project will be overseen by Yayasan Hasanah.

A healthier, fitter you (with apologies to Radiohead)

The government allocates RM19mil to implement the Healthy Malaysia National Agenda (Agenda Nasional Malaysia Sihat) to encourage a healthy lifestyle and reduce the risk of of diabetes, hypertension and obesity.

As much as RM28mil will be allocated to carry out programmes like MyFit, Hari Sukan Negara and the Inspire programme for the disabled.

Higher lifestyle tax relief

The limit of the ‘lifestyle tax relief’ has been raised from RM2,500 to RM3,000, which is an increase of RM500 specifically for sports-related expenditure, including entrance participation fees for sports competitions. The scope of the relief has also been expanded to include subscription to electronic newspapers.

Assistance for rubber smallholders

To help rubber smallholders, the rubber production incentive will be increased from RM150mil to RM300mil, with an expected 150,000 smallholders to benefit from this. Another RM1.7bil will be allocated in forms of subsidies, assistance, and incentives for farmers and fishermen.

RM50 e-wallet credit for the youth

The government through the eYouth Programme (Program eBelia) will credit a one-off RM50 to e-wallet accounts of those aged between 18 and 20 years old. With the allocation of RM75mil, the initiative will benefit some 1.5mil youths.

Community centres for childcare

Community centres will be provided as a place of care for children after their school session ends.

Early childhood education programmes

RM170mil will be allocated for the early childhood education programmes by the Community Development Department (Kemas).

Tax deduction for employers of senior citizens

Additional tax deductions will be given to employers who employ senior citizens. This tax deduction will be extended until 2025.

RM2.7 billion is allocated for the improvement of rural infrastructure.

Appreciation for artists

RM15mil will be allocated to the Cultural Economy Development Agency (Cendana) for the implementation of various art and cultural programmes that will benefit more than 5000 artists and those who work behind the scenes.

Community programmes

For the Chinese community: RM177mil will be provided for the improvement of education facilities, housing and new village development.

For the Indian community: RM100mil be allocated to the Indian Community Transformation Unit (MITRA) to empower the socioeconomic status of the Indian community.

PenjanaKerjaya

Under the recruitment of workers under Social Security Organisation (Socso) known as the PenjanaKerjaya:

Incentives for workers earning RM1500 and above will be increased from a rate of RM800 a month, to 40% from of its monthly salary, limited to an incentive of RM4000 a month.

Employers will be given an additional incentive of 20% to encourage job opportunities for people with disabilities, those who are unemployed long-term and workers who have been terminated.

For sectors with high reliance on foreign workers such as those in construction and plantation sector, a special incentive of 60% of the monthly salary will be provided with 40% channeled directly to employers and 20% to local workers to replace the foreign workers.

These incentive will be given for a period of six months.

Those hired under the PenjanaKerjaya, the maximum cost of the training programme that can be claimed by employers will be raised from RM4000 to RM7000 to undergo the a high-skilled programme or a professional certificate programme.

Optomising the value of Malay reserve land

RM750mil will be allocated to Pelaburan Hartanah Berhad (PHB) under the 12th Malaysian Plan to increase the value of Bumiputra reserve land.

Lower EPF contributions

The EPF contribution rate for workers will be reduced from 11% to 9% starting January 2021, for 12 months, worth a total of RM9.3bil.

Reskilling and upskilling programmes

RM1 billion will be allocated for upskilling and reskilling programme involving 200,000 people.

LOWER TAXES … for some

The income tax of those earning between RM50,001 and RM70,000 will be lowered by one percentage point, expected to benefit 1.4 million taxpayers.

For a period of two assessment years, the income tax exemption limit for compensation paid upon job loss will be increased from RM10,000 to RM20,000 for every year of service completed.

Bantuan Prihatin Rakyat (BPR)

The Bantuan Sara Hidup (BSH) assistance package will be changed to Bantuan Prihatin Rakyat (BPR) with better assistance.

1) Those with a household income of less than RM2500, and with a child will receive RM1200, while those with two children or more will receive RM1800.

2) Those with a household income of between RM2501 and RM4000, and with one child will receive RM800, while those with two children or more will receive RM1200.

3) Those with a household income of between RM4000 and RM5001, and with one child will receive RM500, while those with two children or more will receive RM750.

4) Single individuals with an income of less than Rm2500 will receive RM350.

The BPR is expected to benefit 8.1mil people with an allocation of Rm6.5bil.

Welfare assistance for the disabled

To assist the disabled (OKU), the government has agreed to increase the monthly welfare assistance for the group which includes;

1. Non-working OKU allowance increased from RM250 to RM300;

2. Assistance for senior citizens as well as OKU and chronic patients increased from RM350 to RM500;

3. Allowance for OKU workers increased from RM400 to RM450;

4. Assistance for children from poor families to be increased. An increase of RM100 to RM150 per child between the age of seven and 18 years, and up to RM450 per family, or an increase to RM200 for a child aged six and below per family to a maximum of RM1,000 per family.

EPF withdrawal

In a much awaited-move, the government has announced the targeted facility to withdraw EPF savings from Account 1, as much as RM500 per month, amounting up to RM6,,000 for 12 months.

This withdrawal is to assist EPF members who have lost their jobs, and is expected to lighten the financial burden of 600,000 affected members.

Taking into account both the i-Lestari initiative as well as the Account 1 withdrawal facility, the total of cash withdrawal is up to RM12,000.

It is projected that the total payment for Account 1 withdrawals will involve RM4bil.

Eligible members can apply starting January 2021.

Life and health

The government will expand mySalam protection for medical device cost claims such as stents for the heart, or prostheses.

The government also intends to expand social protections for the B40 group through a voucher programme for life insurance.

Each B40 recipient will be given RM50 vouchers as financial assistance for products such as takaful and personal accident insurance.

At the same time, the government will also extend the period of stamp duty exemption on all life insurance products, not exceeding RM100, for another five years until the 2025 assessment year.

BPN2.0 second phase payments in 2021

The BPN was introduced to reduce cash flow burdens for the rakyat who are affected in the wake of the Covid-19 pandemic.

In 2020, BPN and the Bantuan Sara Hidup (BSH) involved the channelling of RM21bil to 10.6 million recipients. In January 2021, the BPN2.0 second phase payments amounting RM2.2bil will be channelled out.

Pneumococcal immunisation programme

A pneumococcal immunisation programme will be implemented for children with an allocation of RM90mil which is expected to benefit 500,000 children.

#KitaJagaKita

The Finance Minister says he is touched with the #KitaJagaKita spirit among Malaysians, and recalls the story of Bertam-born Rosnizam Ishak, who started a marinated lamb business using Bantuan Prihatin Nasional, creating job opportunities for those in the vicinity.

He also cites the example of Pajan Singh Kirpal Singh, who provided free accommodation for frontliners posted to Kuantan during the movement control order and recovery movement control order period, and Michelle Kugan, a crystal and pearl entrepreneur who used micro loans under the National Entrepreneur Group Economic Fund (Tekun) to sustain her business in Tuaran, Sabah.

Thus, Budget 2021 is crafted for Malaysians and themed “Teguh Kita, Menang Bersama”.

Pro-vaxxers

To encourage Malaysians to get preventive vaccinations to curb the spread of diseases, the government will expand the scope of tax exemption for the medical treatment covering vaccination expenses such as pneumococcal, influenza and Covid-19.

Tax exemption will be given for the vaccination costs for self, spouses and children limited to RM1,000.

Tax relief

The government will raise the tax relief limit on personal, spouse and child medical treatment for serious illnesses from RM6,000 to RM8,000. In addition, the tax relief for a full health screening will be increased from RM500 to RM1,000.

The tax relief on expenses for medical treatment, special needs and parental care has also been raised from RM5,000 to RM8,000.

Big budget

Govt allocates RM322.5bil, or 20.6% of our Gross Domestic Product (GDP), for Budget 2021. This is an increase from its total expenditure allocation for 2020, which has been revised upwards to RM314.7bil from the initial budget estimate of RM297bil.

Every individual in B40 group will receive a special voucher worth RM50 to buy takaful hayat and personal accident insurance.

An allocation of RM24mil is provided to address mental health issues by strengthening Mental Health, Terrorism and Injury Prevention Program as well as Substance Abuse.

The maximum tax relief for individual, spouse and children's medical expenses for serious medical ailments raised to RM8,000 from RM6,000

Fight the good fight

RM150mil will also be allocated for the National Disaster Management Agency (Nadma) to coordinate efforts to fight Covid-19.

Hail the frontliners

To honour the sacrifices of frontline workers in handling the Covid-19 pandemic, the government has agreed to a one-off payment of RM500 to them, which is expected to benefit 100,000 people.

For 2021, the government said it will allocate RM1bil more to fight the third wave of the Covid-19 pandemic.

For the year 2020, the government has allocated RM1.8bil for the implementation of the movement control order (MCO) as well as related public health facilities related to Covid-19 among which is to purchase personal protection equipment (PPE), reagents and consumables.

The government will raise the ceiling of the Kumpulan Wang Covid-19 by RM20bil to RM65bil to fund the Kita Prihatin initiative.

The government proposes to raise the ceiling of the Covid-19 Fund by RM20bil to RM65bil.

Three main objectives of Budget 2021

Firstly: The wellbeing of the people

Secondly: Business continuity

Thirdly: Resilience of the economy

Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz points out that Malaysia has gone through a challenging year in 2020. He says that never in modern history has a plague caused such an impact.

We will get through this!

Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz: The government expects the economy to recover in 2021, and to grow by between 6.5% and 7.5% in line with the stimulus packages and Budget 2021.

Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz begins his speech.

Speaker allows the request and calls all MPs to enter the hall.

Let us in!

Opposition leader Datuk Seri Anwar Ibrahim urges that more MPs be allowed into the Hall to hear and debate the Budget 2021 proposal.

Move aims to help more Malaysians

KUALA LUMPUR: The government’s decision to lower the age of eligible singles for Bantuan Prihatin Rakyat (BPR) was aimed at widening the scope for welfare to more Malaysians who are facing the brunt of the Covid-19 economic fallout.

National Budget Office director Johan Mahmood Merican (pic) said the revised criteria for BPR, which replaced Bantuan Sara Hidup (BSH), was set to benefit 8.1 million Malaysians.

“After taking into account the current state of the economy, the Covid-19 crisis, issues pertaining to cash flow as well as cost of living faced by many households and singles, the government decided it is appropriate to improve the BPR by lowering the age limit for singles to 21 and above, ” he said.

Single individuals with an income of less than RM2,500 will receive RM350.

He noted that the singles category for cash aid was briefly removed in 2019 then reintroduced in 2020, but recipients had to be 40 years old and above.

At the same time, Johan said a total of RM6.5bil had been set aside in Budget 2021 for BPR and the figure was based on estimates made by the Finance Ministry.

“If any household or singles meet the criteria, their application will be approved, ” he said during a media briefing in Wisma Bernama here yesterday.

He said the salary range for households was revised after taking into account the Household Income and Basic Amenities survey report 2019, which found that most households in the B40 group were surviving with salaries of about RM5,000 a month.

Johan noted that the previous BSH only benefited 4.3 million recipients.

He said those who qualified for BPR would be allowed to apply once the Finance Ministry opens the registrations early next year.

The data of BSH recipients would be included into the BPR system and there was no need for them to reapply, he added.

Johan said Budget 2021 was drafted based on the same methods and approaches used by the government during previous budgets.

“Based on the information available with the Finance Ministry, we felt that Budget 2021 reflects the actual situation, ” he added.

Johan, who echoed Prime Minister Tan Sri Muhyiddin Yassin’s remarks that the government’s priority was to help the needy during the Covid-19 pandemic, assured those in the M40 income group they were not being sidelined.

He pointed out the various tax incentives and reliefs in Budget 2021.

Related news:

Budget 2021: Eligible households to receive up to RM1,800 in cash aid under Baabtuan Prihatin Rakyat...

Bantuan Prihatin Rakyat to be open for new registrations by January 2021 ...

Budget 2021: Bantuan Prihatin Rakyat to replace Bantuan Sara Hidup..

No heckling or political swipes - Budget 2021 ... - Malaysiakini

Budget 2021: Quick Highlights On Everything That Happened ...

Budget 2021 Official Website

Industry players and CEOs give their views

AmBank Group CEO Datuk Sulaiman Mohd Tahir says the government’s Budget 2021 is one that is reflective of the need for mitigatory measures to manage the continued impact of the Covid-19 pandemic.

Highlights of Budget 2021 proposals | The Star

INTERACTIVE: What's in it for the people in Budget 2021 ...

Budget 2021: RM180 telco credit for B40 group (updated)

The programme is expected to benefit eight million individuals and will kick off in the first quarter of next year.

Budget for tech

Budget 2021 a boon for bond market

Related post:

European Central Bank president Christine Lagarde (pic) said the economic recovery is “losing momentum more rapidly than expected” after