Continuously escalating sanctions on preventing Chinese technological advancement is disgraceful

Consumers queue up to experience the new Huawei Mate 60 Pro on September 3, 2023, in Shanghai. Photo: VCGChina's Foreign Ministry on Friday slammed the US' abuse of state power in cracking down on Chinese firms, and stressed that US sanctions, containment and crackdowns won't stop China's development but will only enhance its resolve and capabilities for tech self-reliance and innovation, after the US reportedly started an investigation into Chinese-made chips used in Huawei's new phones.

The remarks came as the Chinese telecom giant started pre-sales for several new smartphone models on Friday morning, with many models sold out immediately, drawing even greater attention to Huawei, after reports of advanced chips used in its new smartphones sent shockwaves through China and abroad, particularly in the US, where officials are reportedly seeking to step up the crackdown on the company.

Chinese experts said that the growing popularity of Huawei's smartphones among Chinese consumers serves as a reminder that unilateral sanctions and crackdowns do not work and could backfire, and cooperation, not crackdown, should be the common aspiration of the world.

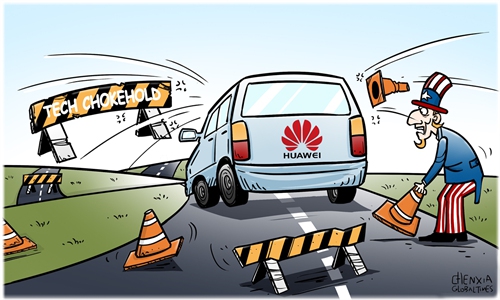

Breaking through barriers. Illustration:Chen Xia/GT

Crackdown won't work

At a regular press briefing on Friday, Mao Ning, a spokesperson for the Chinese Foreign Ministry, was asked to comment on the US government's official probe into an advanced Chinese-made chip in Huawei's latest smartphones.

"We oppose politicizing trade and technology issues and overstretching and abusing the concept of national security. The US has abused state power to suppress Chinese companies," Mao said, adding that such moves violate the principle of free trade and international trade rules, destabilize the global industrial and supply chains and serve no one's interests.

"I want to stress that sanctions and curbs will not stop China's development. They will only strengthen China's resolve and capability to seek self-reliance and technological innovation," the spokesperson said.

Reports of chips used in Huawei's latest smartphones have sparked widespread speculation. In the US, many anti-China politicians are once again beating the drum for more sanctions and crackdowns on the Chinese firm.

However, that didn't seem to affect consumers' enthusiasm for the company's new smartphones. On Friday morning, Huawei launched pre-orders for several new smartphone models, including the Mate X5, the new Mate 60 and Mate 60 Pro models, which sold out immediately. Another round of pre-orders took place late on Friday afternoon, and the phones were sold out within just a few minutes of their launch, the Global Times learned. The deposit is 1,000 yuan ($136), but the prices for some models have not been disclosed yet.

While the company did not disclose specific details about the chips used, there has been widespread speculation in media reports that the Mate 60 series utilizes the Kirin 9000S chip, featuring 7nm technology and stacking technology, with HarmonyOS as its operating system.

Huawei has not announced the processor model of its new foldable screen phone Mate X5, but it is expected to be equipped with the same Kirin 9000S as the Mate 60 series, and may even have the rumored Kirin 9100, according to media reports.

The topic of Friday's new launch has drawn billions of views and received more than 200,000 comments on China's social media platform Sina Weibo, as of press time, with many netizens unable to hold their excitement as they rush to place orders.

The company's new launch has flabbergasted some US officials, who are pledging to look into the new products with a suspicious mindset of whether any US technology may be involved, according to media reports. The US Commerce Department, which enacted a series of restrictions against Huawei and China's chip industry over the past two years, said it's working to get more information on a "purported" 7-nanometer processor discovered within the Mate 60 Pro, Bloomberg reported on Friday.

Huawei's latest smartphone has also triggered a debate in Washington about the efficacy of sanctions intended to contain China, the report said.

Some Western media outlets have also been hyping so-called "widening curbs on iPhone use by government workers." Reuters reported on Friday that such "curbs" have raised concerns among US lawmakers and fanned fears that US tech companies heavily exposed to China could take a hit from rising tensions between the countries.

Asked about the reported claims at a regular press briefing on Friday, Mao said that China has always promoted high-level opening-up. "Products and services from any country are welcome to enter the Chinese market as long as they comply with Chinese laws and regulations," Mao said.

The spokesperson further noted that "this is fundamentally different from the abuse and disguise of the so-called 'security' concept by certain countries to suppress and contain Chinese companies."

On August 29, Apple announced that it would be holding a press conference on September 13 (Beijing time), during which it is expected to unveil the iPhone 15 series and a new Apple Watch. Given the timing, many foreign media outlets have been hyping the competition between Apple and Huawei's smartphones in the Chinese market.

Cooperation should be pursued

The US is undoubtedly uneasy about Huawei's new phone release and reportedly pledged to launch an investigation into it, but since Huawei is confidently announcing it, both the company and its suppliers seem prepared and unintimidated, Ma Jihua, a Beijing-based senior industry analyst, told the Global Times on Friday.

The US' frustration is also a clear indication that the US' blocks against the Chinese company have failed, and they do not have any better cards to play, Ma said, adding that such sanctions only prompted Chinese companies to reduce their reliance on the US and come up with their technologies and products.

"As technical containment has proven ineffective, for the US, the most practical strategy is to move away from zero-sum games and toward a cooperative path for win-win outcomes," the expert said.

US crackdown measures have and will continue to damage the interests of US companies, analysts noted. Meanwhile, some US industry insiders have also called for cooperation.

John Neuffer, president of the US Semiconductor Industry Association, said that no country can reverse the chip supply chain, and the semiconductor industry needs China, according to Yuyuan Tantian, a social account affiliated with China Media Group.

US view of China’s technology progress arrogant, shortsighted

Breaking through barriers. Illustration:Chen Xia/GT

The South China Morning Post (SCMP) published an article on Wednesday saying two physicists at Stanford University had expressed pessimism over the future of the US-China Science and Technology Agreement (STA), given the intense anti-China political sentiment in Washington.

The physicists, who collected signatures from 1,000 scientists and scholars at US universities, have called on the US government to renew the deal. We can only hope that their "petition" will awaken some people in Washington.

The US government extended for six months the symbolic agreement to cooperate with China in science and technology, which was due to expire on August 27. However, this "does not commit the US to a longer-term extension," a State Department spokesperson told Reuters in August. According to the SCMP report, some US lawmakers opposed an extension, citing fears such as intellectual property theft.

What those US lawmakers are not aware of is that renewal of the deal would be beneficial to the US. They should reflect on their shortsightedness.

The distorted US view of China's technological progress is the main culprit in undermining bilateral scientific and technological cooperation. For example, Huawei's latest flagship mobile phone, Mate 60 Pro, recently shocked American politicians who didn't understand how the country would have the technology to make high-end chips after sweeping efforts by the US to restrict China's access to foreign chip technology.

Many politicians in Washington follow this ridiculous logic. They believe China cannot make high-end chips on its own. Therefore, if these cutting-edge technologies can't be legally imported from the US or its allies, then they are "stolen." It's a bit ironic that after the release of Huawei's mobile phone, some US politicians failed to reflect on the futility of US export bans on China, but instead focused on finding loopholes in export restrictions and trying to prevent Chinese companies from using them to "steal" US technology. This reflects the arrogant mentality of US political elites, who ignore the progress of Chinese technology.

How does the US academic community view the issue of China's so-called intellectual property theft? In an August 24 letter, Peter Michelson of Stanford University and his colleague Steven Kivelson told US President Joe Biden that "cutting off ties with China would directly and negatively impact our own research."

Kivelson was quoted by the SCMP as saying that "in my field, which is the study of quantum materials, China has invested more than the US," so many of the experiments that his colleagues conduct will benefit from the discoveries made in China and freely available. "We benefit directly from that when lines of communication are open," he said.

One thing is clear: China-US technology cooperation is beneficial to the US. However, some politicians in Washington are addicted to hyping so-called intellectual property theft, using national security as an excuse to wantonly undermine technology cooperation, which will harm US technological development and innovation capabilities.

The US-China STA serves as an umbrella agreement for the science and technology relationship between the US and China. Renewing the STA is in the interests of the US. We hope that politicians in Washington can view China-US technology cooperation from an objective perspective, as well as its positive impact on the US economy, and abandon their arrogance and geopolitical mentality.

The US-China STA, signed in 1979, has been renewed every five years or so ever since. In the 1970s and 1980s, China's technology strength was relatively weak, so the US-China STA may have been more advantageous for China.

But today, with the rise of China's technological power, China-US technology cooperation has shifted toward being beneficial to the US. Technology cooperation is a big cake for the US economy. For example, without the US chip export ban, Huawei could have become an important buyer of US chips, driving the development of the US chip industry.

China is an important market for US technology products. Any behavior that disrupts China-US technology cooperation is a very shortsighted move.

China firmly opposes US' reported probe into Huawei chips: crackdown will only enhance tech self-reliance: FM

China's Foreign Ministry said on Friday that products and services from any country are welcome in China as long as they are in line with Chinese laws and regulations, responding to US media reports claiming that China is “restricting” use of Apple's iPhones by government officials.