|

Turning a blind eye: The grumblings over exposed hills are growing louder but little is being done to rectify the situation

|

Grievances from residents warning of environmental damages must not fall on deaf ears

“Leaders who don’t listen will eventually be surrounded by people who have nothing to say.”

MY family home in Kampung Melayu, Air Itam in Penang, is more than 56 years old. That’s about my age, and it has never been hit by floods. Not once!

But last week, my parents – dad is 92 years old and mum, 86, – had their sleep rudely interrupted sometime after 1am by water gushing into their home.

They have been sleeping on the ground floor for years now because they are too old to climb the stairs to their bedroom.

The water that flowed into their room almost touched the top of their bed but fortunately, one of my nephews and his wife from Kuala Lumpur were staying over that night.

It was so fortunate that they were there to calm my anxious parents down and assure them all would be fine. They managed to comfort my stunned folks, who had never experienced such an unpleasant situation before. My father had to be carried to the room upstairs as the house remained flooded throughout the early morning.

Our home was filled with layers of mud the next day and the cars parked outside were all damaged. They sadly look like write-offs.

My father’s pride and joy, his first-generation Proton Saga car – which he bought in 1985 – is now unusable.

A week on, my brothers and nieces are still cleaning up the mess from the massive flood. They haven’t had the time or mood to even assess the financial losses.

And bound by a common sentiment as Penangites, they are tired of the blame game, a trade the state’s politicians have plied to near-perfection.

How many times can the finger be pointed at the previous government, with the incumbent almost 10 years in power? And how many more times can we blame it on torrential rain, which came from Vietnam – or wherever? Worst of all is, when discussions are mooted on flood issues, the voices of the people are swiftly silenced.

It appears that even to talk about hillslope development, one would have to contest in the elections, or be perceived to be challenging the state government, or more extremely, be some kind of lackey in cahoots with the Federal Government.

Blaming everyone else except oneself is simply a way of covering up one’s weaknesses. But the discerning public, in a maturing democracy with heightened transparency and a huge middle class like Penang, will not tolerate such short-term manoeuvring for long.

Suddenly, civil society – a buzzword among politicians – has vanished, with NGOs now regarded as irritants and an affront to the state establishment. Politics is apparently the monopoly of politicians now.

As the National Human Rights Society aptly puts it, “With the benefit of hindsight, we are sure that the Penang government now realises that they should not so readily malign civil society, howsoever obliquely – for the legitimate and well-founded articulation of matters of great concern to civil society.

“This is because it undermines the fundamental values of a functioning democracy and the fundamental human rights of the populace at large.”

Perhaps, the state political elites, many of whom aren’t pure blood Penangites, don’t realise the state is the home of a vibrant civil society, with many active NGOs and activists who are respected influencers of society.

Having walked through the corridors of power and appreciated power’s pleasures, perks and the adulation it brings, maybe it is becoming much harder for people to take criticism. This is, in fact, a reflection of the arrogance of power.

Many have developed thin skin now, with little tolerance for the slightest form of criticism. If anyone even dares raise their voice, an army of cybertroopers, hiding behind anonymity, are unleashed to attack them.

Freedom of speech, it seems, is only the domain of the opposition, with some media (regarded as unfriendly) unceremoniously ridiculed and questioned for their attendance at press conferences.

There are politicians from the Federal Government, too, who are shamelessly cashing in on the flood situation in Penang.

Their relief work must be splashed across news pages, and they have to be seen wading through the flood waters for dramatic purpose. Phua Chu Kang’s iconic yellow boots could likely be the hottest item in the state, as politicians bask in the media’s glare.

Ridiculous remarks have also been passed, one even blaming the state government, saying it has earned the wrath of God.

The rain and floods will go away, eventually. Penangites are stakeholders in the state, and they don’t only make up politicians. The state doesn’t belong to the state government or the opposition.

Caught up in the thick of the action, we seem to have forgotten that the hills are crumbling even without rain. As a stern reminder, just last month, a landslide buried some people in Tanjung Bungah. Investigations on that tragedy are still ongoing.

Basically, the trees – which act as sponge on the hills – are gone. We don’t need to be soil experts to know that.

The grumblings are growing louder because the hills have been progressively going bald in recent years. But the voice of discontent has fallen on deaf ears.

Penangites are alarmed at what they are seeing, and they don’t like it one bit, as much as they understand that land is scarce on the island and property developers need to source some to build homes on.

While it’s easy to hang the Penang state government out to dry for its follies, it’s difficult to ignore how the floods in the east coast states have become annual affairs, too. So, what effective flood mitigation plans have been put in place there?

Kelantan has suffered senselessly, and after more than a year of having been subjected to Mother Nature’s havoc, many victims have yet to recover from their losses. Flooding is obviously nothing exclusive and doesn’t discriminate. Every state has, unfortunately, experienced it in some shape or form.

So, irrespective of location, when life returns to normal, you can expect the politicians to resume their old denying ways.

If there’s a thread that binds our politicians – regardless of which side of the political divide they come from – it is their inability to apologise for their mistakes, despite waxing lyrical about accountability.

Don’t expect them to say sorry, because an apology would be admission of guilt, or worse, a sign of weakness in their realm of inflated egos.

And to put things into perspective, perhaps we could learn a lesson from a quote by prominent American pastor Andy Stanley – “Leaders who don’t listen will eventually be surrounded by people who have nothing to say.”

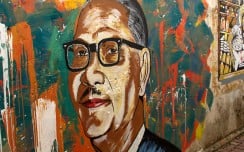

On the beat Wong Chun Wai

On the beat Wong Chun Wai

Wong Chun Wai began his career as a journalist in Penang, and has served The Star for over 27 years in various capacities and roles. He is now the group's managing director/chief executive officer and formerly the group chief editor.

On The Beat made its debut on Feb 23 1997 and Chun Wai has penned the column weekly without a break, except for the occasional press holiday when the paper was not published. In May 2011, a compilation of selected articles of On The Beat was published as a book and launched in conjunction with his 50th birthday. Chun Wai also comments on current issues in The Star.

Related posts:

Behind BJ Cove houses at Lintang Bukit Jambul 1 is an IJM Trehaus Project.

Becoming bald: A view of the clearing work

seen at Bukit Relau which was visible from the Penang Bridge in November

last year. GEORGE...

Council should not bow to development or

political pressure, says city councilor, Khoo ‘Politicians should

be ‘wakil rakyat’ and n...

Seeking solutions: Penang Forum member and

soil expert Dr Kam Suan Pheng giving her views during the dialogue

session themed ‘Penang Fl...

It’s hard to deny when the effects of

climate change are all around us Andrew Sheng says that from

increasingly intense hurricanes t...

Choong (in white) surveying the deforested

hillslope next to Majestic Heights. PENANG MCA has raised concerns

about the safety of the r..